Have you ever been envious of the people on your instagram feed taking stress free vacations while your boss is waiting for you to hand in a status report you definitely haven't even started working on?

Let us let you in on the secret…most of these people have no debt. Keep reading if you're wondering, “How can I pay off my debts quickly?” Because being debt free opens up a whole new world of possibilities, the ones where your instagram feed is just as envy inducing.

Whether you’re about instagram glam or not, becoming debt free is as simple as making additional payments towards your debt. Doing this will do three very important things for you as you start your path towards financial freedom.

By making additional payments you can:

Save On Interest

Since your interest is calculated on your remaining loan balance, making additional principal payments or a payment that is larger than the required monthly payment will significantly reduce your interest payments over the life of the loan. Even small additional principal payments can help you reduce the amount of interest you’ll pay.

Shorten the Loan Term

Making additional principal payments will shorten the length of your loan term and allow you to become debt free faster. Because your balance is being paid down faster, you’ll have fewer total payments to make, in-turn leading to more savings.

Improve Credit

In most cases paying more than the minimum payment improves your credit by lowering your DTI (Debt to Income) ratio and by showing your ability to lenders that you can afford to pay more. They call it your minimum monthly payment for a reason, it’s the minimum obligation.

With these sacrifice come challenges but there are easier ways

Challenges of sending extra payments

Most of the time you are not going to see the projected savings or the years you take off of your debt when you send a measly twenty dollars towards it, but that measly twenty dollars can end up saving you thousands on interest and make you debt free faster.

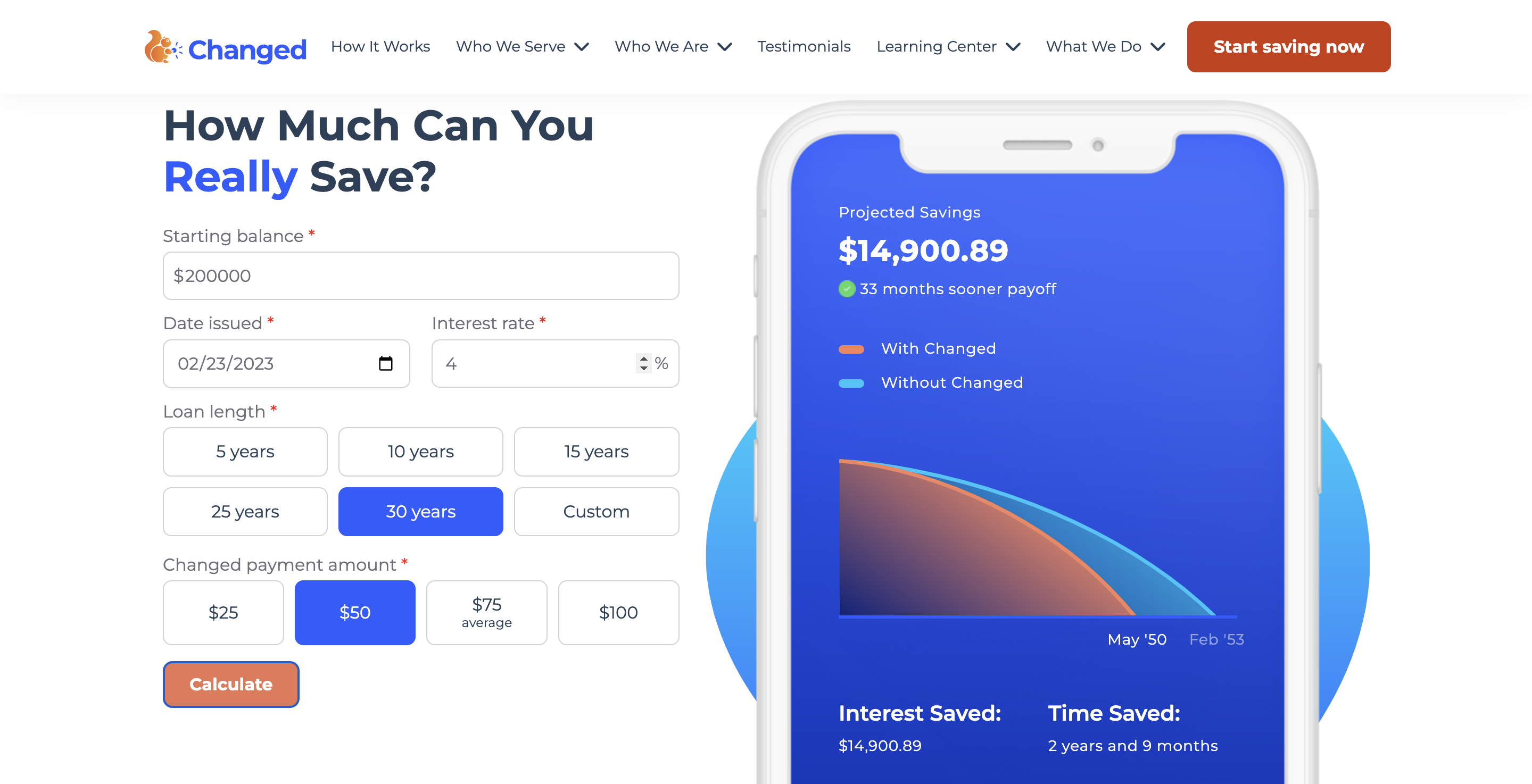

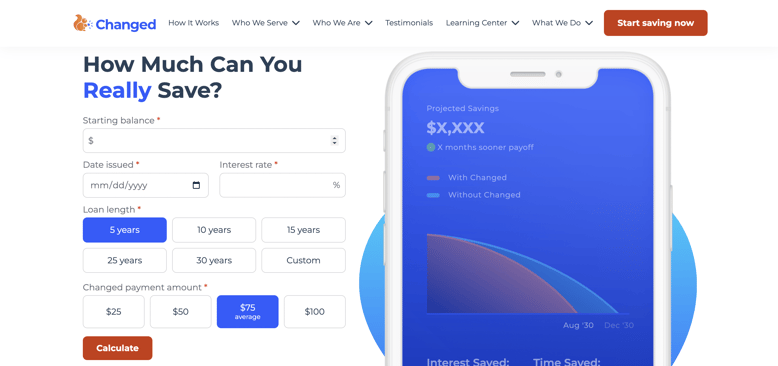

Which is why Changed shows you how every extra dollar you send towards your debt can impact how much time and money you spend serving your debt.

Don’t believe us, check out our Changed Calculator to see how much you can really save.

Other hacks to make extra payments towards your loan?

Biweekly Payment Method: Instead of making one large payment every month, break up your payment into every two weeks.

This is perhaps the most effective way to make extra payments, most of us get paid bi-weekly, why not make bi-weekly payments?

When you split your payments like this, you’re making the equivalent of 1 extra monthly payment a year (26 bi-weekly payments totals 13 monthly payments). This extra payment may be applied directly to your principal balance.

Irregular Extra Payments: You can make additional payments towards your loan at any point of your loan term. Have some extra cash flow or come into some unexpected money? Consider using that towards your loan. Any extra payment can help you reduce your loan term and the interest you will end up paying in the long run.

The Changed platform makes this seamless by allowing members to Roundup their every day purchases or make scheduled transfers we call Boosts towards their debt automatically. Your grandma sent you a crisp 20 dollar bill for your birthday, schedule the 10 dollars towards your debt by using the Boost feature.

Here at Changed our mission is to make every penny count, because a little goes a long way. With Changed, you can see exactly how much your micropayments can go towards you becoming debt free faster so you can have the perfect instagram feed too.