Paying off debt can feel like a daunting task, and honestly, it kinda sucks. But we've got some great news! By sending an extra $50 towards your mortgage, auto loan, personal loan, or student loan each month, you'll be ahead of most people in your goals to be debt-free. And when you combine that strategy with the power of the Changed app, you'll be unstoppable. Here's how an extra $50 and the Changed app can help you achieve your financial goals.

Benefits of Sending an Extra $50 Toward Your Debt

Sending an extra $50 towards your debt each month may not seem like a lot, but it can have a big impact on your finances. Here are some of the benefits of sending an extra $50 each month:

- You'll save money on interest and reduce the amount of interest you pay over the life of the loan.

- You'll pay off your debts faster and be debt-free in no time.

- You'll free up more money in your budget for other financial goals.

- You'll improve your credit score by reducing your credit utilization ratio and proving to lenders that you're actively working to reduce your debt.

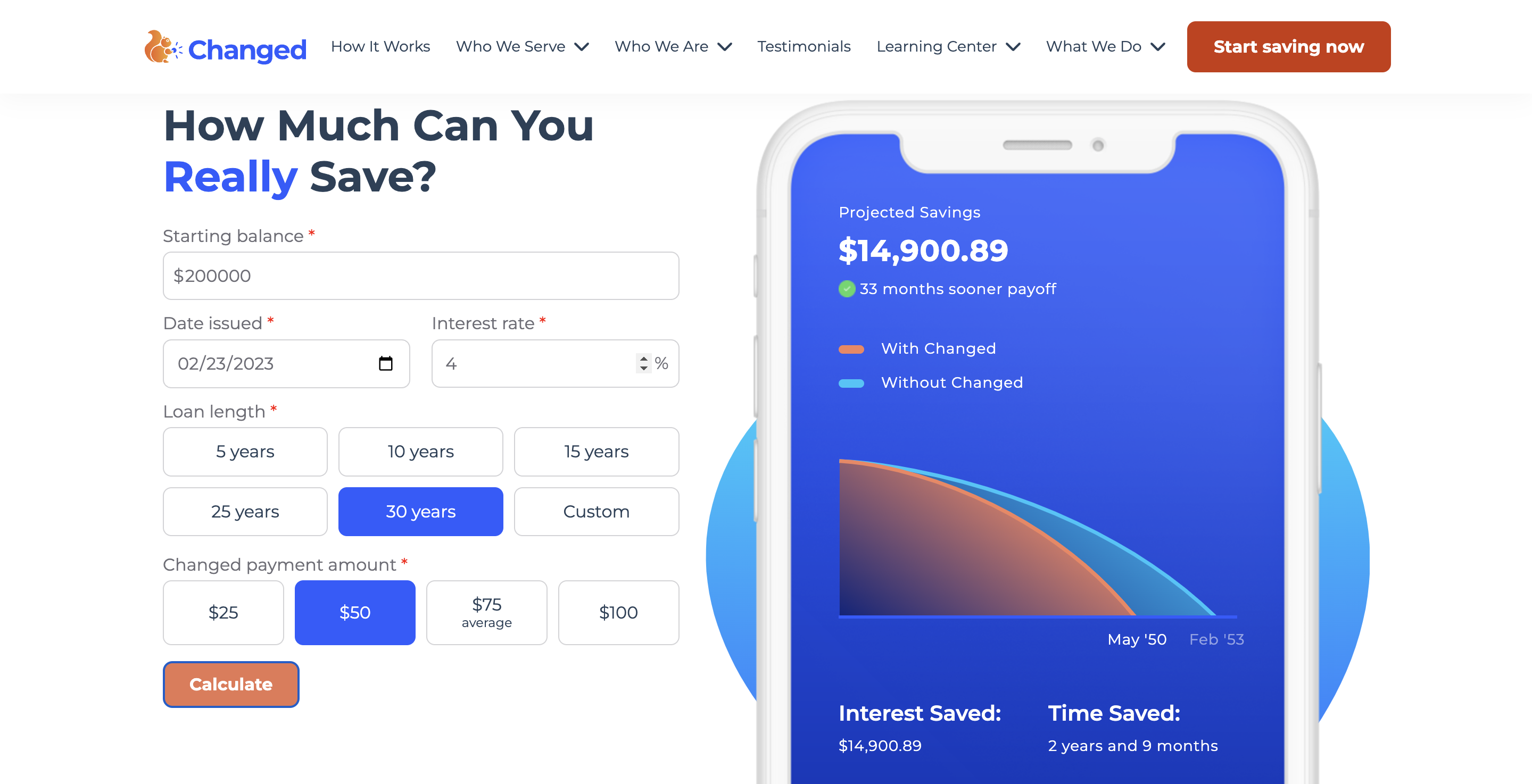

Here's an example of how sending an extra $50 toward your mortgage each month can make a significant impact:

Mortgages: Let's say you have a 30-year fixed-rate mortgage with an outstanding balance of $200,000 and an interest rate of 4%. If you add an extra $50 to your monthly payment, you could:

- Save over $14,900 in interest charges over the life of the loan.

- Pay off your mortgage more than three years earlier than the original term.

- Potentially increase your credit score, as paying off your mortgage faster can demonstrate responsible credit behavior to lenders.

The same principle applies to other types of debt, and Changed can help you create a plan to target the best debt to pay down first and help you automate payments to make sure you never miss a payment or incur late fees.

Just input your details on the Changed "How Much Can You Really Save" Calculator.

Here's how the Changed app and an extra $50 can help you achieve your financial goals:

- Identify the best debt to target first: Changed helps you identify the best debt to target first, so you can save money on interest charges and pay off your debts faster. By sending an extra $50 towards that debt each month, you'll speed up the process even more.

- Create a personalized debt repayment plan: Changed creates a personalized debt repayment plan based on your budget and financial goals. The app shows you how much you need to pay each month to become debt-free within a specific timeframe, taking into account your extra $50 payment.

- Automate your payments: By setting up automatic payments, you'll ensure that you're sending an extra $50 towards your debts each month, even if you forget to do it manually.

- Monitor your progress: Changed provides regular updates on your progress towards debt repayment. You can see how much you've paid off, how much interest you've saved, and how much closer you are to becoming debt-free. This can help keep you motivated and on track towards achieving your financial goals.

To Wrap Up

Paying off debt and achieving your financial goals may seem like an insurmountable task, but with the power of the Changed app and an extra $50 a month, you can make significant progress toward your goals. By using the Changed app to create a personalized debt repayment plan and automating your payments, you'll be on the fast track to becoming debt-free. And by sending an extra $50 towards your debts each month, you'll reduce the amount of interest you pay and pay off your loans faster. So don't wait any longer, download the Changed app today and start saying "bye-bye, debt!"