Credit scores impact many aspects of your life: whether you get a loan or credit card, what interest rates you pay, or whether you get an apartment you want so you can finally move out of your parent's house. The Changed App now allows you to track your credit score every day without affecting your credit.

Having a good credit score can also help you in several other ways:

-

Lower Insurance Premiums: Some insurance companies use credit scores as a factor in determining premiums for auto, homeowner's, and renter's insurance. A higher credit score may result in lower insurance premiums.

-

Qualify for Better Loan Rates: Beyond mortgage loans, having a good credit score can also help you qualify for better rates on personal loans, auto loans, and student loans. Lenders are more likely to offer favorable terms to borrowers with higher credit scores.

-

Access to Higher Credit Limits: With a good credit score, you're more likely to be approved for higher credit limits on credit cards and lines of credit. This can provide you with greater financial flexibility and purchasing power.

-

Faster Approval Processes: Lenders often prioritize applicants with good credit scores, leading to faster approval processes for loans and credit applications. This can be particularly advantageous in situations where you need access to funds quickly.

-

Utility and Cell Phone Service Approval: Some utility companies and cell phone providers may check your credit score before approving service. A good credit score can make it easier to establish utility accounts or sign up for cell phone plans without requiring a security deposit.

-

Negotiating Power: When negotiating terms with lenders or service providers, a strong credit score can give you leverage to secure better terms, such as lower interest rates or waived fees.

-

Employment Opportunities: While not as common as other uses, some employers may perform credit checks as part of the hiring process, especially for positions that involve financial responsibilities. A good credit score could potentially enhance your employment prospects.

-

Apartment Rentals: In addition to landlords, property management companies may also consider credit scores when evaluating rental applications. A good credit score can increase your chances of being approved for an apartment lease, and it may even help you negotiate lower security deposits or rental rates.

Overall, maintaining a good credit score can have a significant impact on your financial well-being, opening up opportunities for better terms and saving you money in various aspects of your life.

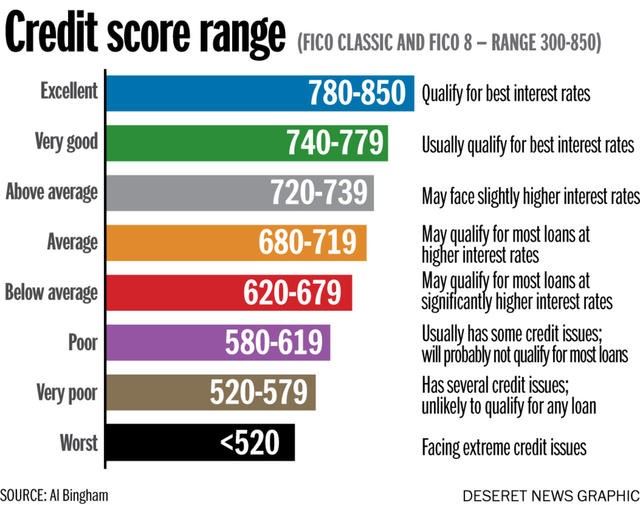

Credit Score Ranges

Your credit score can range anywhere from 300 which is extremely poor to 850 which is very good. Borrowers with scores above 750 or so have many options, including the ability to qualify for 0% financing on cars and for credit cards with 0% introductory interest rates.

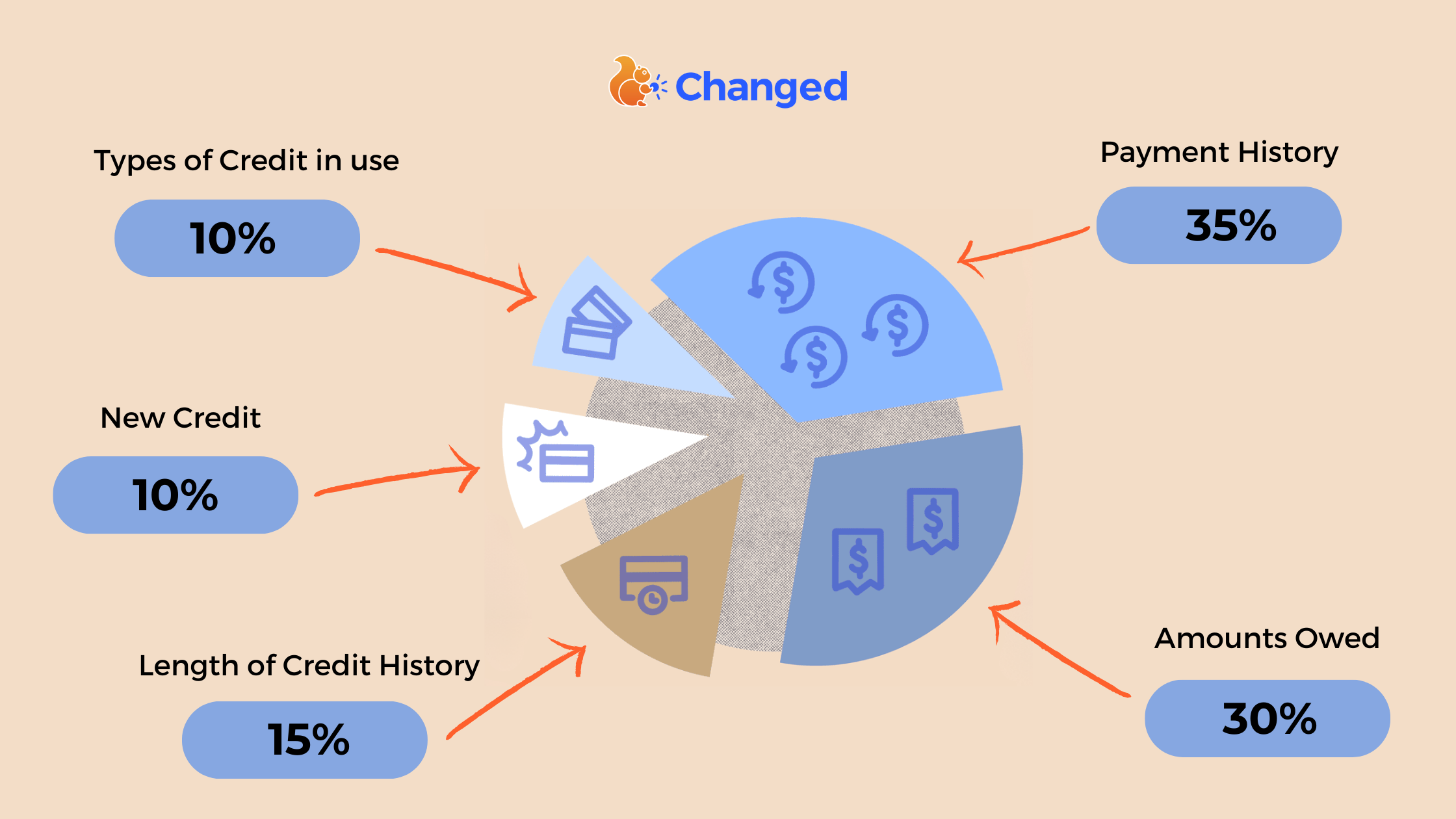

There are 5 factors that make up your credit score:

-

Payment History: This is the most critical factor in determining your credit score, typically accounting for about 35% of the total. It reflects whether you pay your bills on time. Late payments, defaults, bankruptcies, and other negative marks can significantly lower your score. Conversely, consistently paying bills on time can help boost your score.

-

Amounts Owed (Credit Utilization): This factor accounts for around 30% of your credit score. It looks at how much debt you currently have compared to your available credit limits, also known as your credit utilization ratio. Keeping this ratio low (usually below 30%) is generally better for your score. High credit card balances relative to your credit limits can indicate financial strain and may negatively impact your score.

-

Length of Credit History: This factor considers the length of time your credit accounts have been established. It looks at the age of your oldest account, the average age of all your accounts, and the age of your newest account. A longer credit history can be beneficial, as it provides more data for lenders to assess your creditworthiness. This factor typically makes up about 15% of your credit score.

-

Credit Mix: Lenders like to see a diverse mix of credit types, such as credit cards, installment loans (like auto loans or mortgages), and retail accounts. This factor accounts for around 10% of your credit score. Having a mix of different types of credit demonstrates your ability to manage various financial obligations responsibly. However, it's essential to only apply for credit you actually need and can manage effectively.

-

New Credit and Recent Inquiries: This factor accounts for about 10% of your credit score. It considers how many new accounts you've opened recently and how many recent inquiries lenders have made into your credit report. Opening several new accounts in a short period or having multiple recent inquiries can indicate financial distress or an increased risk of default, potentially lowering your score. However, it's important to note that when you're rate shopping (such as for a mortgage or auto loan), multiple inquiries for the same type of credit within a short timeframe typically count as a single inquiry to minimize the impact on your score.

Understanding these factors and managing your credit responsibly can help you maintain a healthy credit score, which, as discussed earlier, can have numerous benefits in various aspects of your financial life.

The Changed App now allows you to track your credit score every day without affecting your credit.

Why should you regularly monitor your credit?

Regularly monitoring your credit score can help you maintain it and even improve and increase your credit score if it is lower than you'd like.

How can you improve your credit score?

If you have a credit score that is low, you can improve it by tackling and managing your debt. Reducing your debt to income ratio will help you get a higher credit score rating.

-

Timely Bill Payments: Punctual bill payment constitutes 35% of your credit score. Demonstrating consistency in meeting payment deadlines is crucial for maintaining a favorable credit score. Ensure timely settlement of monthly mortgage installments and strive to clear credit card balances in full each billing cycle. Such responsible payment behavior is highly regarded by credit bureaus.

-

High-Interest Debt Repayment Priority: Address high-interest debts as a priority to mitigate the risk of accruing further liabilities, thus safeguarding your credit score. By settling these obligations first, you effectively reduce your overall debt burden, leading to potential score improvement.

-

Addressing Accumulating Small Balances: It's imperative to prevent the accumulation of small balances across multiple credit cards. While individual debts may seem insignificant, their collective impact can adversely affect your credit score. Strive to eliminate these balances to maintain a healthier credit profile.

-

Resolution of Past-Due Accounts: Even when debts are considerably overdue, it remains imperative to fulfill outstanding obligations. While immediate credit score enhancement may not be substantial, addressing recent past-due accounts takes precedence, gradually contributing to score improvement.

-

Management of Student Loan Repayment: Prioritizing the repayment of student loans is a great financial strategy, as it reduces your debt-to-income ratio. Additionally, since student debt is non-dischargeable in bankruptcy, failure to address it could lead to wage garnishment. Consistently meeting loan repayment obligations reinforces positive credit behavior, bolstering your credit score even post-debt settlement.

But it’s worth noting a debt payoff in this case could result in a change to your debt mix, thus impacting your score negatively. Student loans are considered installment loans, because you pay a fixed amount each month, while credit cards are a vehicle for revolving debt. Credit bureaus like to see both types in your file.

Check out our blog that explains this in more detail right here.

Will checking my own credit scores result in a hard inquiry?

No. This is reported as a soft credit check, so it won’t lower your scores. You can check your credit for free through the Changed App.

Unlike hard inquiries, soft inquiries won’t affect your credit scores. Since soft inquiries aren’t connected to a specific application for new credit, they’re only visible to you when you view your credit reports.

Having a good credit score can make a world of difference in how you live your life. It can open many financial doors for you and the Changed App is right there with you every step of the way.

Download the Changed app today!