Learn Something New

Earn Perk Points

Win Free Cash

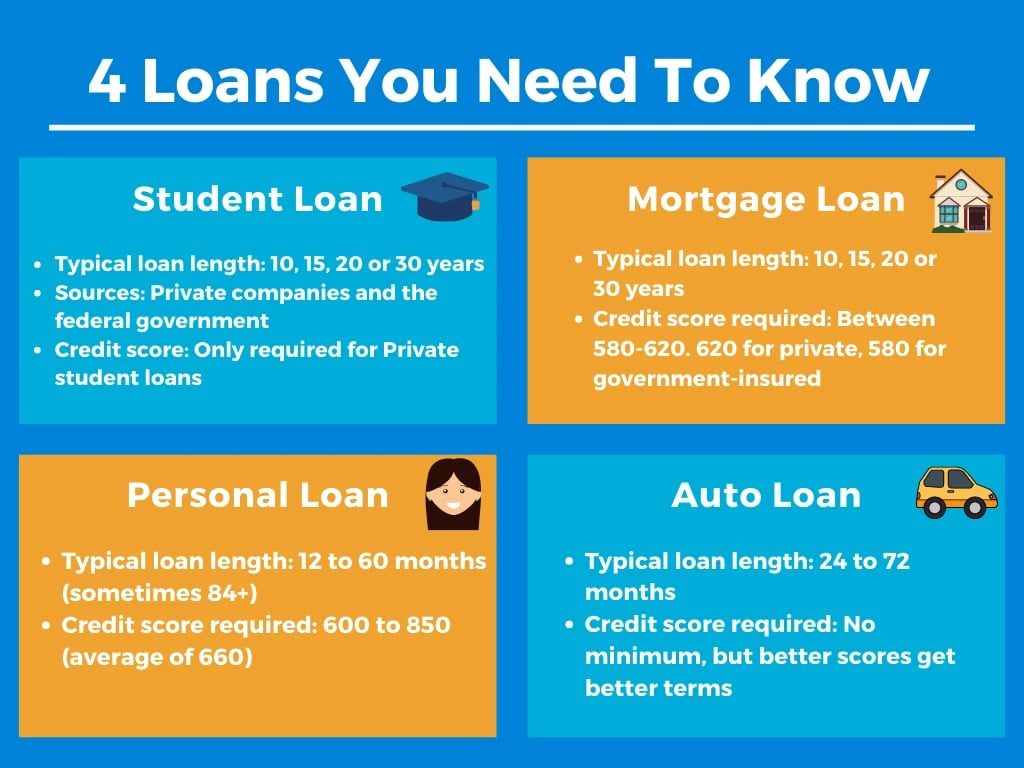

Student Loans

Student loans. Student debt. Sallie Mae. The Devil. Whatever you call them, you probably are familiar! School is expensive, and not everyone can pay for it, so you might take out a student loan. This type of loan is designed to help you pay for tuition, books, supplies, and living expenses. Students loans are given out through the federal government or private companies. The best choice typically depends on how much your schooling will cost. We will dive even deeper into student loans in later courses!

Mortgage

For most people, a home is the most expensive item they will consider purchasing. Those who don’t have all the money to purchase a home up front, which is basically 99.9% of us, will take out a mortgage. Mortgages are secured loans, which means the borrower promises collateral to the lender if they cannot continue payments. For mortgages, this collateral is the house. If you stop making payments, the lender can take possession of the house. So try hard to keep up with payments!

Tip: Collateral = Something of value/an asset

Personal Loan

You may or may not be familiar with personal loans. These loans can be taken out for a variety of reasons including paying for a major life event, doing work on your home, or paying off other major debts. Most personal loans are unsecured, meaning they’re not backed by collateral. If you don’t qualify for the loan, the lender can make them secured, meaning you can put an asset such as your car or home as collateral.

Auto Loan

Depending on where you're living, having a set of wheels can be crucial. Cars are no cheap purchase, so you might look into getting an auto loan. This type of loan allows you to pay off a vehicle over time in smaller monthly payments. Much better than dishing out $30,000 on the spot! In most cases, you can get these from your financial institution or the car dealer itself. A forewarning: If you can not make your payments, the lender can repossess the vehicle in order to get their money back.

What is a credit score?

A credit score is the holy grail of three-digit numbers. It is the identifying number that shows how responsible you are with your money. It shows how likely you are to repay borrowed money and pay bills on time. Credit scores range from 300 to 850, and the lower the number, the worse the score. A low credit score may or may not keep you from getting credit, but you most likely will have to pay a higher interest rate on loans. You also may have to pay more for car insurance or put down deposits on utilities. There are two main credit scoring models: FICO and VantageScore. FICO is the preferred model, being used in over 90% of U.S. lending decisions.

Tip: The lower your credit, the more it costs you to borrow and to qualify for other services like utilities.

How do I get a low/high credit score?

The way you use your credit and pay bills on time are the two main components that will affect your credit score. Using a low percentage of your credit limit is key. Ideally, you want to use around 30% of your available credit limit. A simple formula to follow is to take the total of balances on all your credit cards divided by the total of all your credit limits. The lower the percentage of your credit limit used, the better.

The other factor is simply paying your bills on time. Late payments can add fees, and if you're late 30 days or more, it can be detrimental to your credit score. Try your best to pay back your debts on time monthly, and you will have amazing credit!

How often should I check my credit score?

Before diving any deeper, let's clear one common misconception up. Checking your score DOESN'T affect your credit! It's good to track your credit rate regularly because it's a good way to see how well you are doing financially. Checking your credit score is much easier than you might have thought, and you can go about it a few different ways.

The first is using a free credit scoring website. There are a variety of websites that offer free credit scores; check out The Balance to see The 8 Best Free Credit Reports of 2021. Another way is to check with your credit card issuer or lender. Many credit card companies offer free credit scores that you can check by logging into your account online.

Tip: Checking your credit score by applying for a loan is considered a "hard pull," and it will affect your credit if done multiple times. A "soft pull" is what free credit scoring services use and is the best way to check the status of your credit without affecting it.

.webp?width=800&length=800&name=Debt%20to%20Income%20Ratio%20(DTI).webp)

What is debt-to-income ratio (DTI)?

Debt-to-income ratio is another key to understanding your financial health and credit worthiness. Lenders will analyze DTI when applying for a loan. Having a healthy ratio can help you build credit and get better terms when borrowing. An easy way to calculate this is adding your monthly expenses and dividing by your pre-tax income.

What is a cosigner?

A cosigner is someone who is creditworthy and is basically taking responsibility for the borrower if payments become an issue. A cosigner can be anyone who is willing to take responsibility for you and your loan. Most of the time, it's a family member who cosigns. The MOST important thing is that the person cosigning is financially stable themselves. A family member is typically the best bet because they know you best and are willing to take the risk. But if their credit is bad or they have some financial instability, it would be better to look elsewhere.

Why do I need a cosigner?

Being able to show financial stability plays a key role in getting approved for any loan. Lenders will look at your borrowing history, credit score, and income to see whether you are capable of taking on new debt. If you have taken some hits in any of those areas, you might be asked to get a cosigner.

To see if you have a sufficient income, a lender might calculate your debt-to-income ratio (check the above section). If you have a high percentage, the lender might suggest a cosigner. Typically around 43% and lower is good. They will also check your credit score, looking for something around 700. Most college students don't have much credit history and very little income, and lenders won't offer a loan to someone who doesn't have a credit history. This is a situation in which a cosigner will be necessary.

What is interest?

In most cases, you cannot borrow money without giving a little extra in return. Interest is the cost for borrowing that money. It is a percentage of your loan that's accumulated daily or monthly and then added to the original loan amount or principal.

Tip: The principal is the original amount of the loan you'll take out before any interest or additional fees.

How does it work?

As mentioned, interest rate will accumulate either daily or monthly. For most loans, this will be a daily charge of interest. Your required payment to your loan will always be the same each month. But before your payment reaches your principal, it will go toward the interest. After the interest is paid, the remaining amount you paid will go toward the principal, so you'll want to know how your interest will be calculated.

Follow this formula: Interest Rate x Current Principal / 365. For example, say I have an interest rate of 5.05% and a current loan balance of $25,000. Do the math: 0.0505 x 25,000 / 365 = 3.45. This means that a total of $3.45 will be added to the loan EACH DAY, making it $25,003.45 after one day. That's a cup of that fancy coffee you always like to get. It seems small now, but over time, that can turn into thousands of dollars if you don't make regular payments!

What is a fixed rate vs. a variable rate?

There are two types of interest rates that you might encounter. A fixed rate stays the same for the entirety of your loan term. A variable rate changes over time. In most instances, a fixed rate is a better option because you will have predictable payments each month. With the predictability, you can better manage and plan each payment.

Variable rates fluctuate with the market so it can be a little unpredictable but often have a lower rate. If you know the market well, a variable rate could be a smart move! But beware; the interest rate could rise suddenly. Most fixed rate loans are also available as variable rates—for example, mortgages, private student loans, and personal loans. Fixed rates tend to be a bit more popular due to their predictability.

Tip: Variable rates are based on the market and consider things such as inflation. If the market is booming, then rates are higher. If the market is struggling, then rates drop. The COVID-19 pandemic is a good example of a struggling market that caused interest rates to drop.

What is a loan term and how long is it?

The loan term is how long it will take you to repay your loan in full when making regular payments. Loan terms can be short or long depending on the loan amount. It all depends on the loan. For example, a 30-year fixed-rate mortgage has a loan term of 30 years (360 months). But auto loans, which are typically less, often are at a 5- or 6-year term. Each loan term is unique to the person. Some might be able to afford a shorter-term loan, but for many, a longer-term loan makes more sense financially.

Is a long-term or short-term loan right for me?

Now that you know what a loan term is, you can probably guess the difference between a long- and short-term loan. Yep, it's that simple. One is a short amount of time and one is longer! Short-term loans are typically repaid within a few months to a few years. Long-term loans usually are repaid for several years. But which one is right for you? Short-term loans are usually used for small things like repairs or quick cash. Long-term loans are used for bigger purchases, the most common one being a home.

An important thing to keep in mind when it comes to deciding what term is best for you is INTEREST. You’ll pay more interest overall on a long-term loan, but your payments will likely be less because it is spread out over more time. If you choose a shorter term, the payments will be higher, but you will not be paying as much in interest.

Are there prepayment penalties?

Always read the fine print! As you just learned, loans have a term that determines when you might pay off your loan. But what you might not have anticipated is that you could get penalized for paying off your loan too early. Sounds pretty ridiculous, right!? A prepayment penalty is a fee that lenders may charge when you pay off your loan balance before the set loan term. Why do they do this? When you pay back your loan faster than expected, lenders earn less interest, which means less profit for them. To avoid these penalties, make sure to check with your lender and see if your loan includes one!

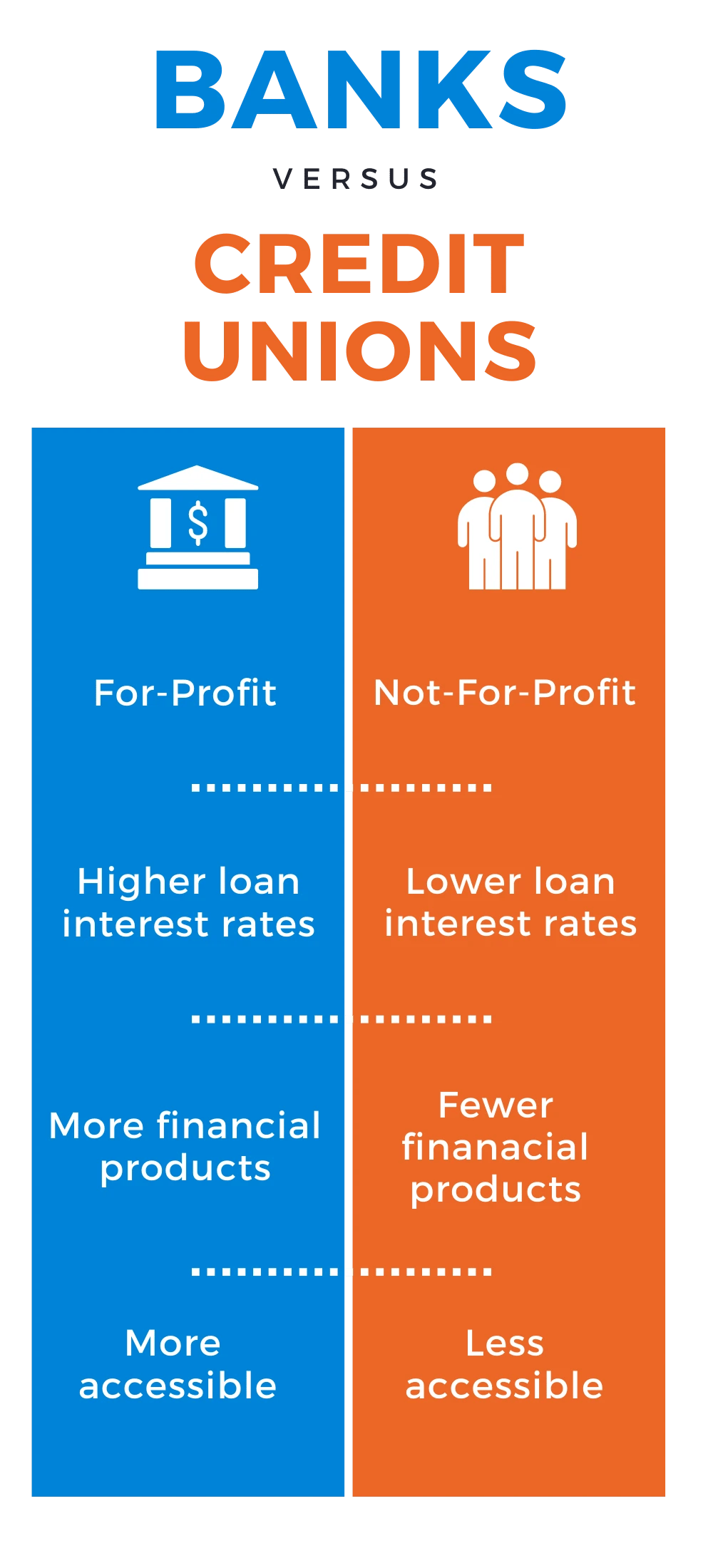

Banks

Your familiarity with financial institutions is most likely associated with banks. We all know our hometown bank or the closest one to us. They come in many forms: large or small, national or local. Their appeal comes from their varying size and easy access. Anyone can join and, because of the size of banks, they tend to have more branches and be readily available at any time. That means they have plenty of ATMS as well as services like 24/7 customer service, weekend hours, and electronic/mobile banking.

Are they the best option to get a loan from? When searching for a loan, you might look into getting it from a bank just because that's what you know best. Big banks offer a variety of financial products and services, and commercial loans are an example of something banks offer but most credit unions don’t. Be warned, though: Banks typically will have higher fees and rates on their loans. Their larger size also often means a sacrifice in areas like personal service at times. This is not always the case, but compared to credit unions, they can be a little less personal.

Credit Unions

Credit unions are financial organizations that are typically smaller and local. You may or may not have heard of your local credit union because they are a bit more specialized than banks. Credit unions can also be more exclusive and require some type of affiliation to join. Where you live, work, or attend school can be factors. Some have opened their doors more and allow their services to a wider group of people. Because of their smaller size, they are slightly behind in terms of mobile banking and financial products when compared to bigger banks.

If you find a credit union and you are eligible to join, they do have a lot of upside! Interest rates at credit unions are some of the lowest on loans. Fees for overdraft and insufficient funds tend to be lower at credit unions as well. Because they are not-for-profit, their goal is to keeps fees and rates low! And who doesn't love great customer service? We all like that personal feel, and credit unions often have top-notch customer service. Credit unions also have begun to join ATM and branch-sharing networks to provide more convenience to their members.

Changed in the News

7 Tips to Prepare Yourself Before Student Loan Repayment

Student loan debt doesn't have to be a mystery. Learn about loan repayment before you get there.

Student Loan Repayment: A Family Affair

Changed has launched the Family and Loved Ones feature so those who want to help most, can.

Read more

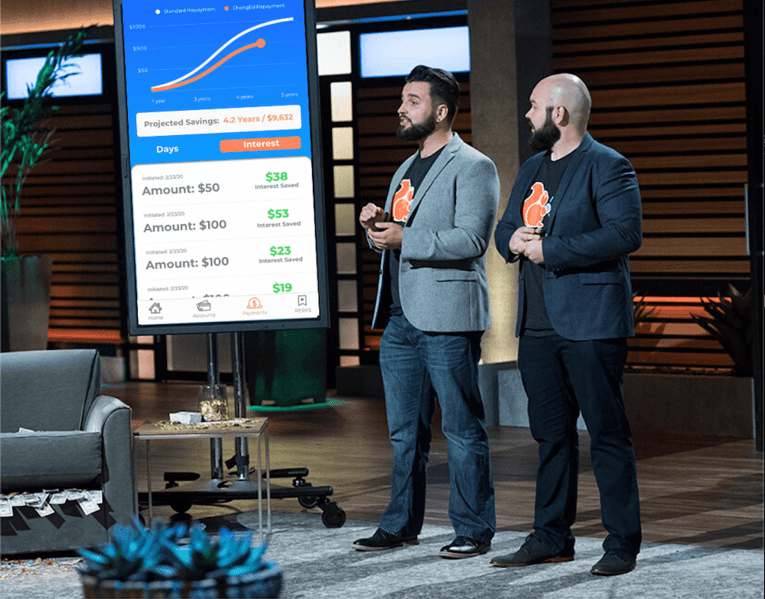

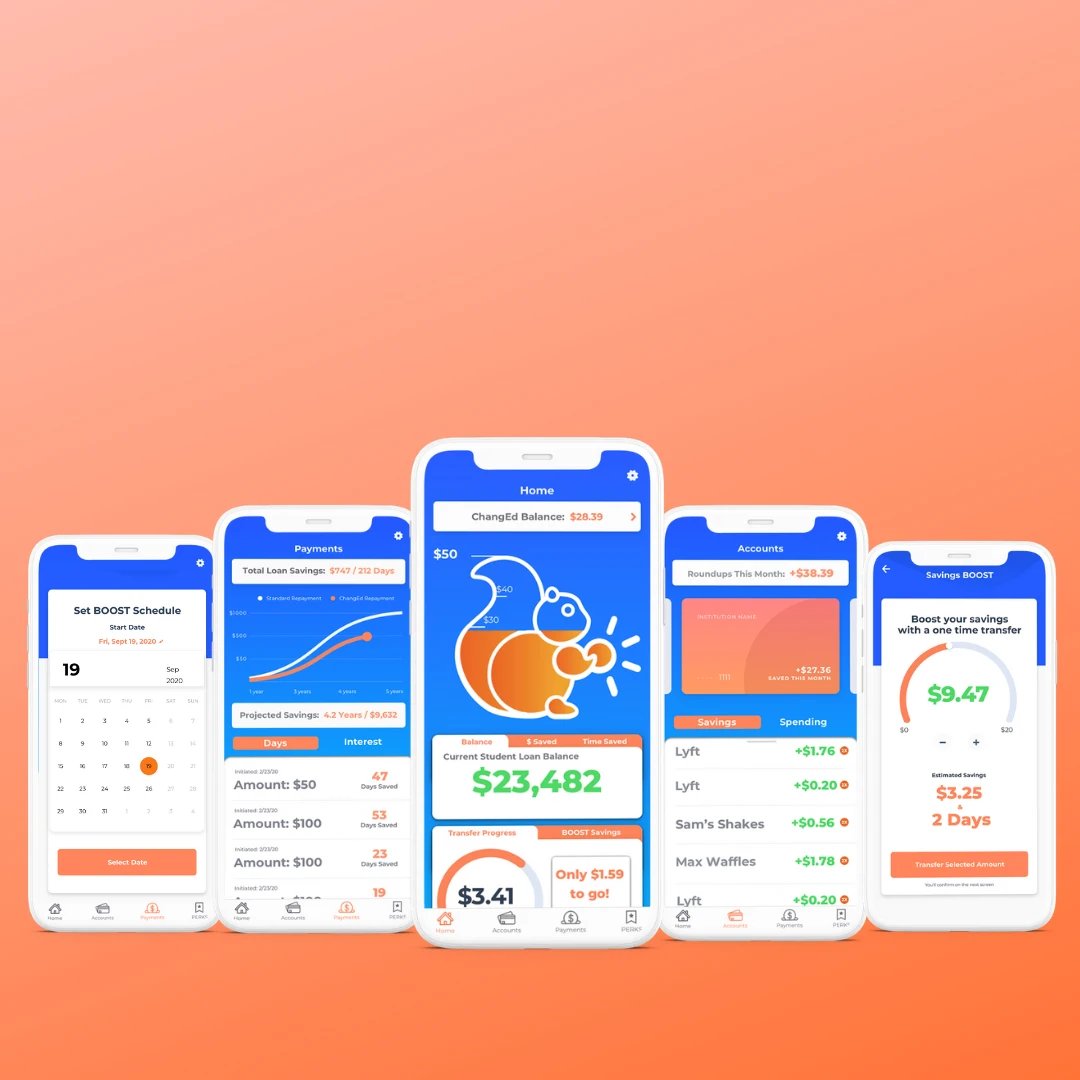

Changed on ABC's Shark Tank

Changed, an app that rounds up the spare change from your everyday purchases to help you pay off your student loans sooner and for less in interest costs, appeared on ABC's popular Emmy-Award-winning reality show Shark Tank.

Read more

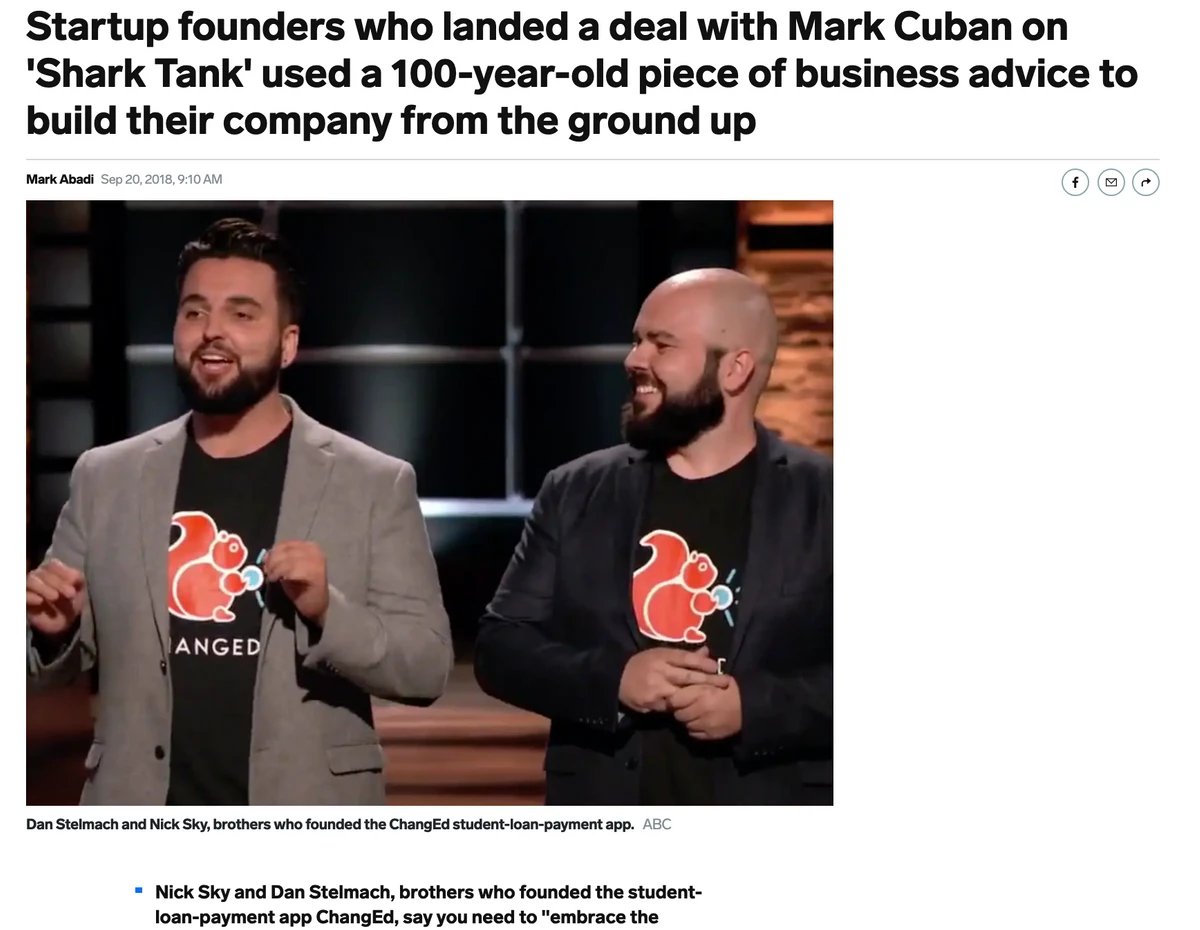

Changed Founders "Embrace the Broom"

Startup founders who landed a deal with Mark Cuban on 'Shark Tank' used a 100-year-old piece of advice to build their company from the ground up.

Read more

Changed Featured in Money Magazine

Three years ago, Dan Stelmach was stuck in a sales job he didn’t like, trapped by the $850 student debt payments he had to make each month.

Read more

Simple Tips to Knock Out Student Loans Debt

Discover simple steps you can start taking today to pay off your debt faster.

Read more