Help a Loved One Get Out of Debt Sooner

You're here to help someone experience life without debt, and we're here to make it easy! To set up an account with Changed:

1. Create a Changed account using your name and email. We create an FDIC-insured account in your name, not your loved one's.

2. Enter your loved one's loan info.

3. Link your accounts. Select your preferred funding account for Changed to make transfers from.

A Step-by-Step Guide

Set it up once and we take care of the rest!

Starting with the Basics

Like any good relationship, we need to get to know you

To create and set up your personal FDIC-insured Changed savings account, we need some personal info. Enter your legal name, date of birth, phone number, and address. Your info will never be used for anything else other than setting up your account.

Next, add your loved one's loan info

Link all loans directly and securely

Securely link all of your loved one's loans to Changed. Once connected, choose which account you want to pay down first. It's that easy. We cover all loan servicers and offer a manual way to add lenders that aren't covered with direct linking.

Then, add accounts you want to save from

Securely link your bank and spending accounts

Last, securely link your bank and spending accounts. Select your preferred funding account for Changed to transfer funds. Changed analyzes roundups from multiple accounts and will transfer from one selected account.

Setup Is That Easy!

Hear from the Squad!

Change the Way You Pay Off Debt

A long, 17-year journey is finally over! Drew can finally relax a bit. He graduated University of Illinois at Urbana Champaign with a degree in Systems Engineering. Currently he works as a Director of Digital Solutions at CBRE.

"How easy it was to 'set it and forget it.' Also, co-founder Nick's early email blasts always put a smile on my face."

Saving That's Truly Simple

Jay is debt free! Eight years later, he has said goodbye to his student loans. He is a graduate of North Central University, where he got a Bachelor of Arts degree in youth ministry. He is currently working as a student ministry pastor.

"I loved being able to save money towards paying off my loan without having to think about it. And timing my extra payments to minimize what I was paying in interest."

Money Matters You Can Measure

After 10 years, Brandy is student debt-free! She attended LSU to earn her nursing degree but tragically was cut due to Hurricane Katrina. Now she works as an AD of strategic pricing for a virtual clinical trials company. Her advice to the squirrel squad is to pay more aggressively!

"I was paying off my loan rather quickly yet I didn't see any noticeable changes in my bank account."

Get to know your Changed app!

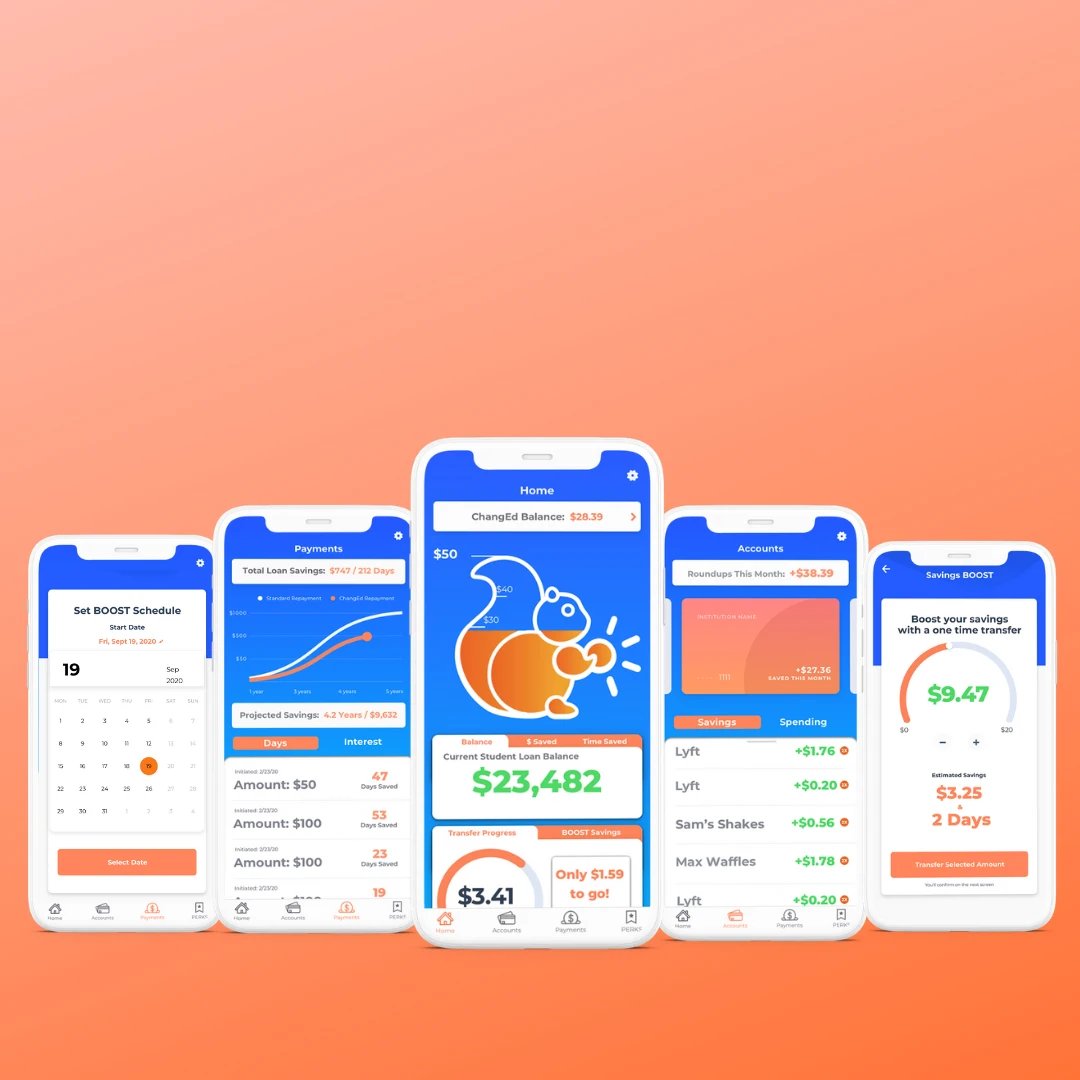

Welcome to Your Payoff Screen

Watch your savings fill up the Changed squirrel

The Payoff screen is your savings and transfer hub. Track your savings, view your transfers, and watch as you get closer to a payment! Transfers are made in $5 increments based on your savings. Once your Changed squirrel fills up, a payment is sent automatically. Set it, forget it, and save!

Pro tip: Boost your savings. Tap the BOOST icon on your home screen to add a one-time transfer to your roundups. You can also schedule BOOSTs daily, weekly, or monthly. It's up to you!

Your Accounts Screen

All your connected accounts in one place

Track each month's roundups and savings from your linked accounts here. Swipe through your accounts and scroll to see just how many roundups each account brings.

Pro tip: The more accounts linked, the more savings!

Your Payments Screen

Track your progress and savings

This is where you will be able to see just how much time and money you are saving with Changed! Check in to see your total savings as well as your projected savings. Track payments, see your savings grow, and say RIP to your debt.

Changed PERKS Program

Earn free payments

Earn Perk Points by referring friends and family and reaching repayment milestones. Those points that never expire are entered into a weekly raffle for your shot at a loan payment on us!

Pro tip: Family and loved ones can be contributors to your student loan. Multiple contributors multiply your savings!

Savings Speed

Customizable saving for everyone

Everyone saves at their own speed. Choose from Budget, Standard, or All mode and see how much you'll save at each speed. Find savings speed options in your settings menu located with each institution you have linked.

Pause Transfers

Save on your terms

Budget tight this month? Don't worry, you have the ability to press pause at any time. Pause for 15, 30, or 60 days; whatever works best for your budget.

See the impact Changed has made for borrowers just like your loved ones.

Changed in the News

7 Tips to Prepare Yourself Before Student Loan Repayment

Student loan debt doesn't have to be a mystery. Learn about loan repayment before you get there.

Student Loan Repayment: A Family Affair

Changed has launched the Family and Loved Ones feature so those who want to help most, can.

Read more

Changed on ABC's Shark Tank

Changed, an app that rounds up the spare change from your everyday purchases to help you pay off your student loans sooner and for less in interest costs, will appear on ABC's popular Emmy-Award-winning reality show Shark Tank Jan. 28 at 8 p.m. CT.

Read more

Changed Founders "Embrace the Broom"

Startup founders who landed a deal with Mark Cuban on 'Shark Tank' used a 100-year-old piece of advice to build their company from the ground up.

Read more

Changed Featured in Money Magazine

Three years ago, Dan Stelmach was stuck in a sales job he didn’t like, trapped by the $850 student debt payments he had to make each month.

Read more

Simple Tips to Knock Out Student Loans Debt

Discover simple steps you can start taking today to pay off your debt faster.

Read more