Are you a borrower? Learn more.

Take a Look Inside the App

See how Changed helps borrowers and loved ones like you.

Create a Profile

Let’s start with the basics. To create and set up your personal FDIC insured Changed savings account, we’ll need to know who you are. Build your personal profile including name, DOB, phone number, and address. With Changed, your information is always secured using bank-level encryption and security standards.

Link Your Loans

Time to link the loans you want to pay off sooner! Securely link your loans in the Changed app using your online login. No account numbers needed! Once you’re in, you’ll choose which account you want to pay down first. We cover all loan servicers and also offer a manual option for outside lenders.

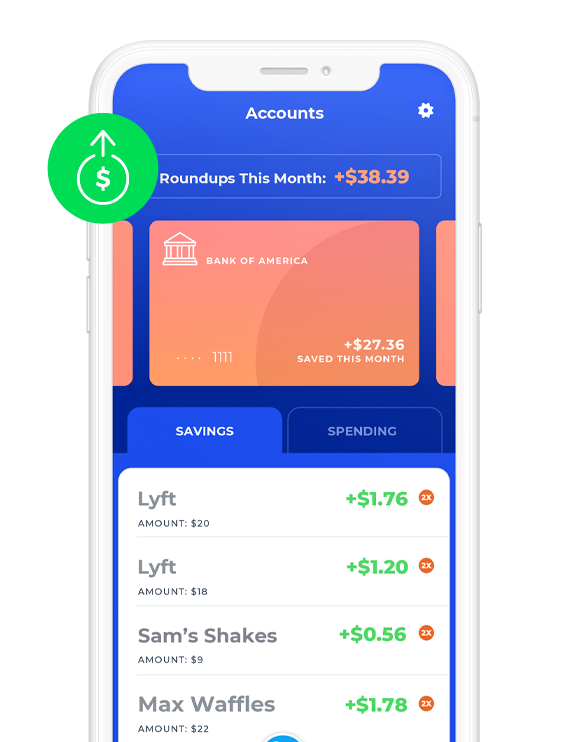

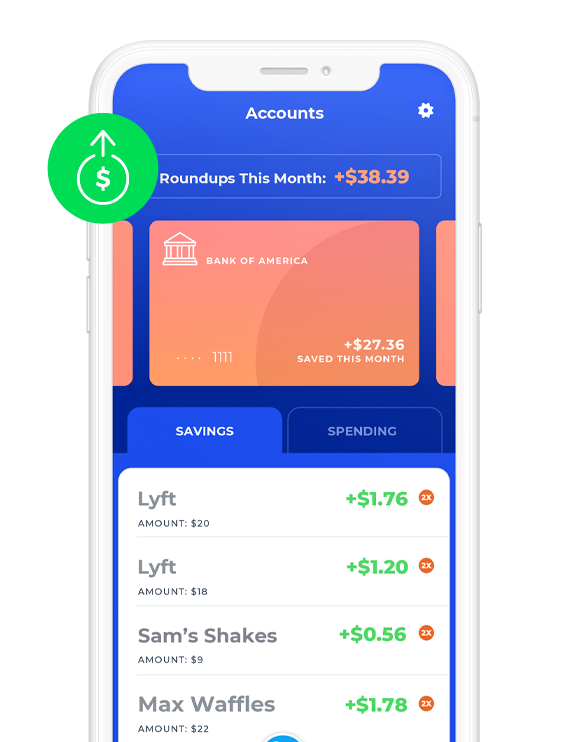

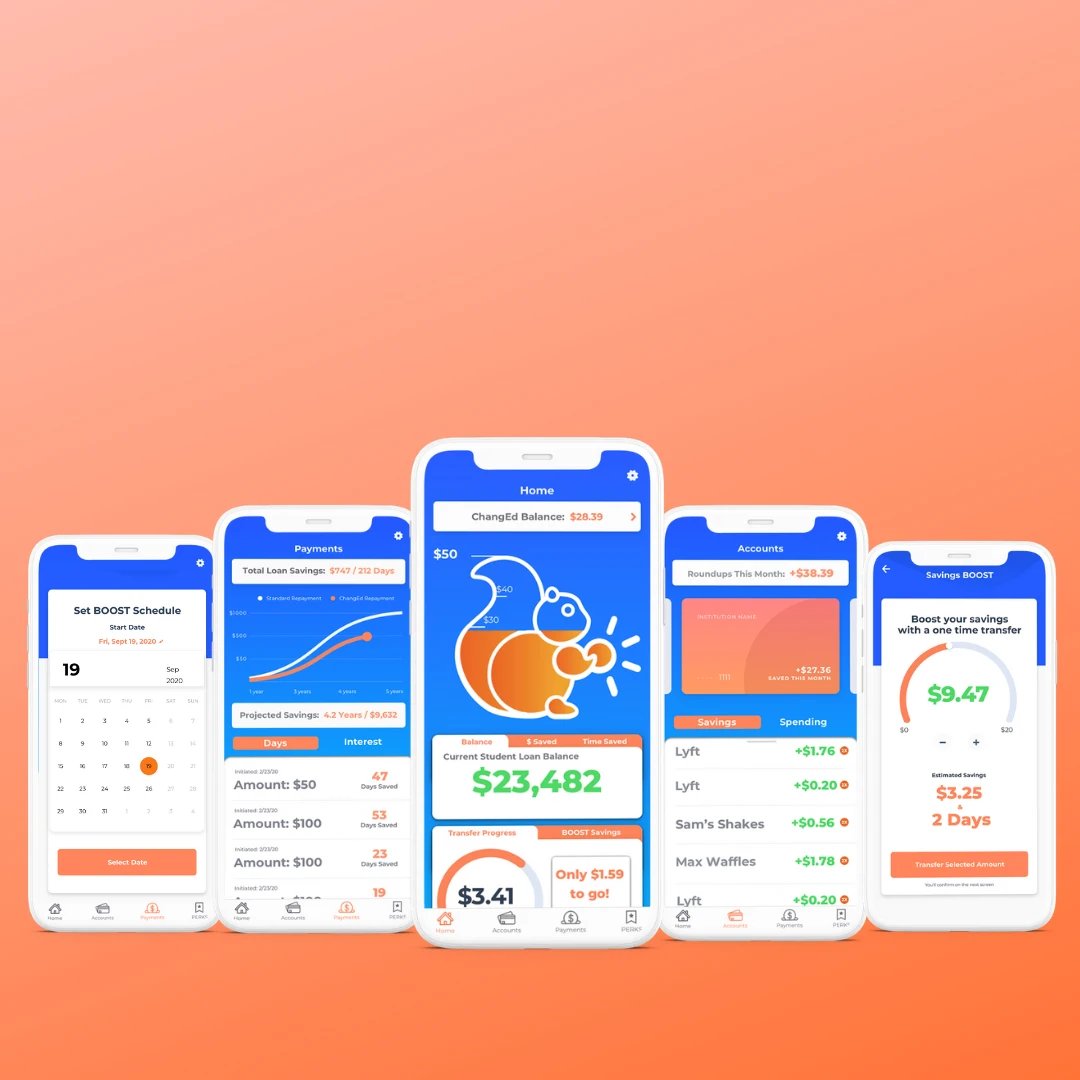

Roundup Your Accounts

Once your accounts are securely connected, you can choose which accounts you want to analyze for roundups. Choose what type of transactions get rounded up and even multiply your roundups so you control how fast you reach your savings goals. Savings are transferred each time you reach $5 in accumulated savings.

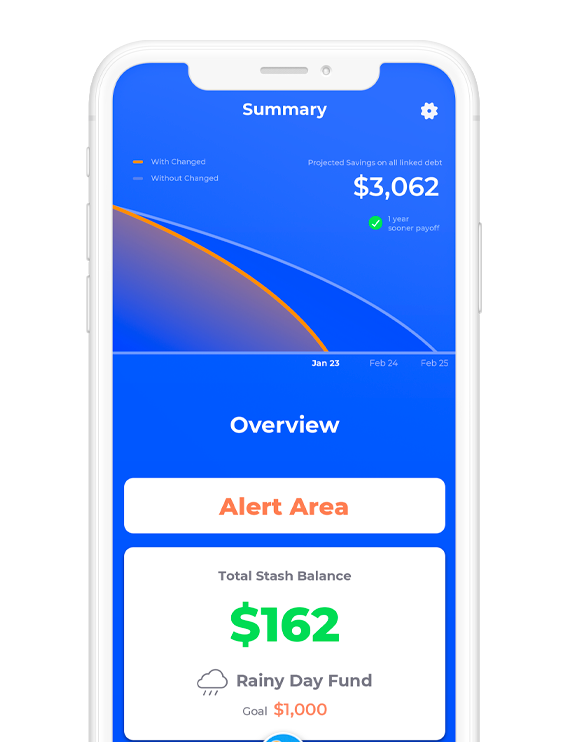

Stash and Payoff

Save for an emergency, pay off your debt, or do both. With Changed, you can use Stash My Cash to reach your savings goals and automate your savings toward your debt with Payoff. You can split your savings between savings and debt pay off to optimize your finances to reach your dreams with less debt.

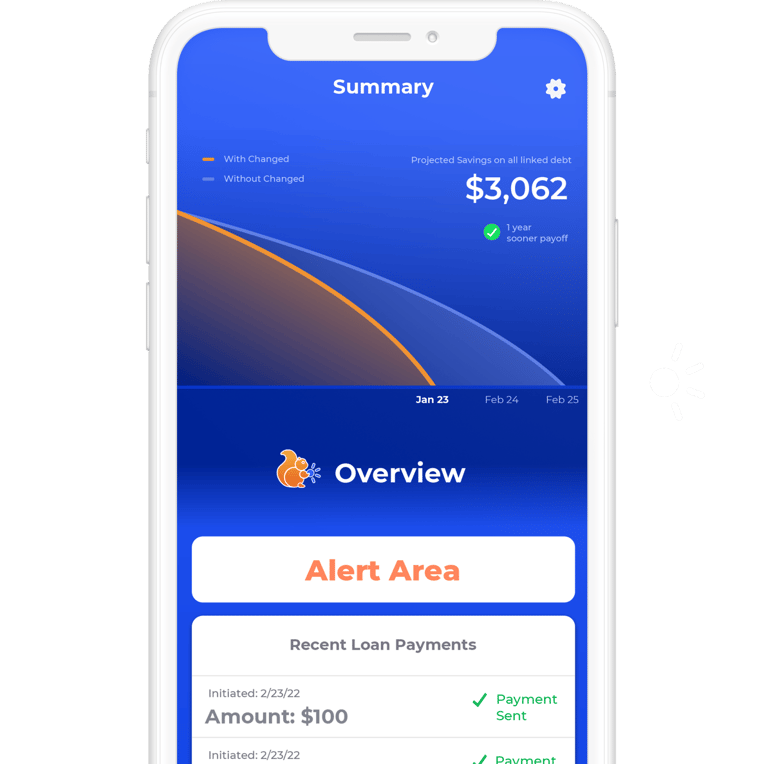

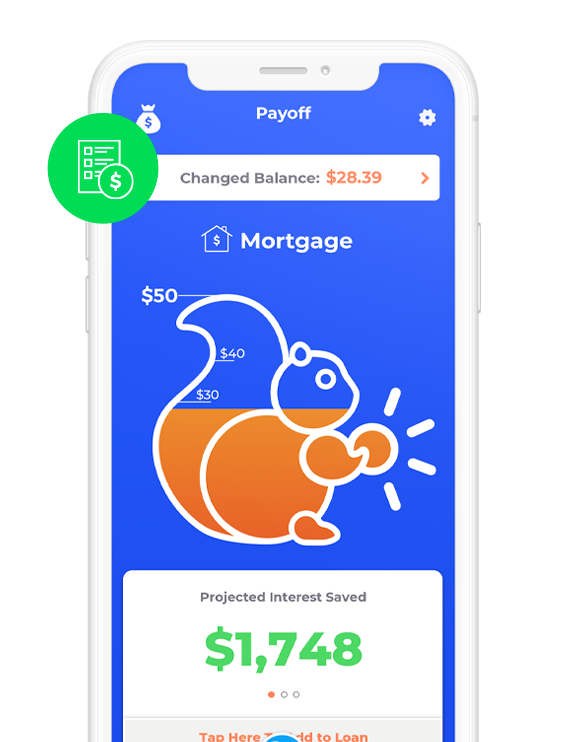

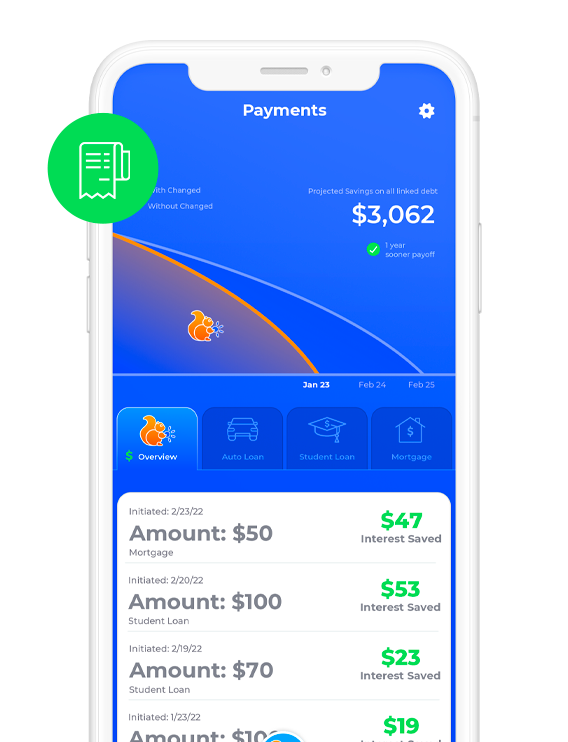

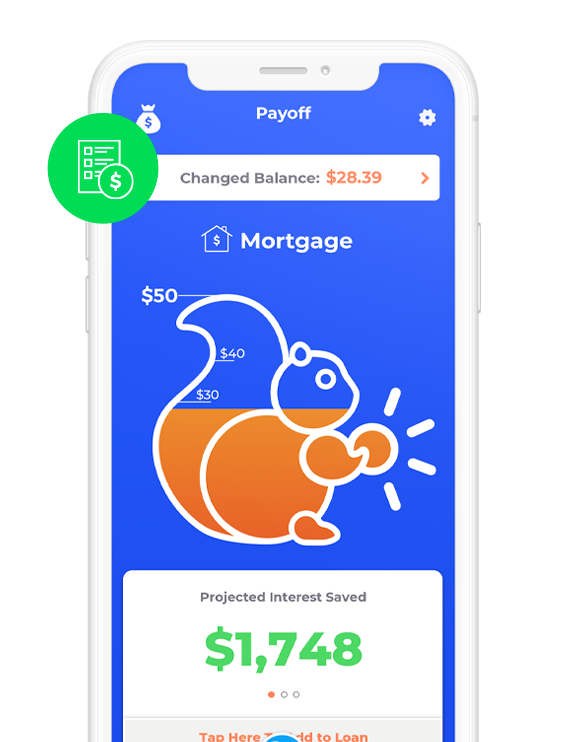

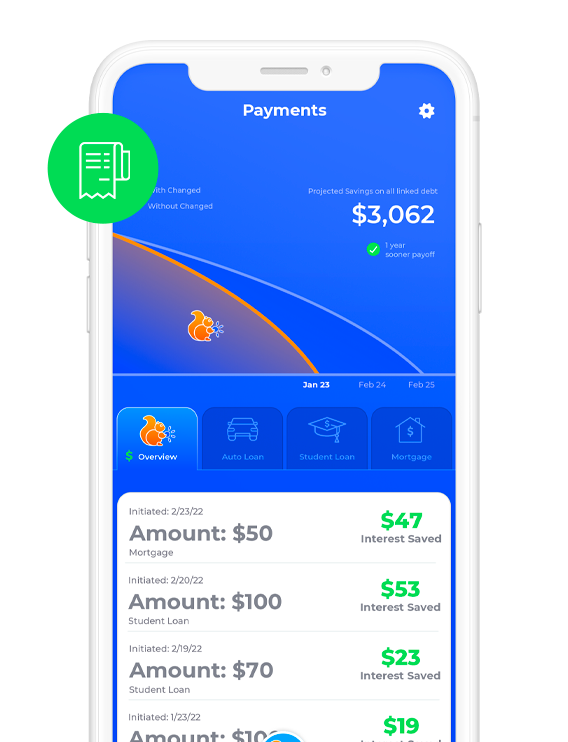

Watch Debt Shrink

Changed automates your small savings into debt payoff progress. Each time your Payoff account reaches $50 in accumulated savings a payment is made to your debt. Track how much each payment saves you in time and interest. See how much sooner you will be debt free based on your debt and your savings. #RIPDebt

It Takes a Village

Paying off debt isn't an easy task but Changed makes it easier. With our ability to add loved ones as contributors, multiple people can help pay off debt together. Help your kids pay off student loans or work together with your significant other to over come debt. With contributors, Changed can multiply your savings to a life without debt.

Create a Profile

Let's start with the basics. To create and set up your personal FDIC insured Changed savings account, we'll need to know who you are. Build your personal profile including name, DOB, phone number, and address. With Changed, your information is always secured using bank-level encryption and security standards.

Roundup Your Accounts

Once your accounts are securely connected, you can choose which accounts you want to analyze for roundups. Choose what type of transactions get rounded up and even multiply your roundups so you control how fast you reach your savings goals. Savings are transferred each time you reach $5 in accumulated savings.

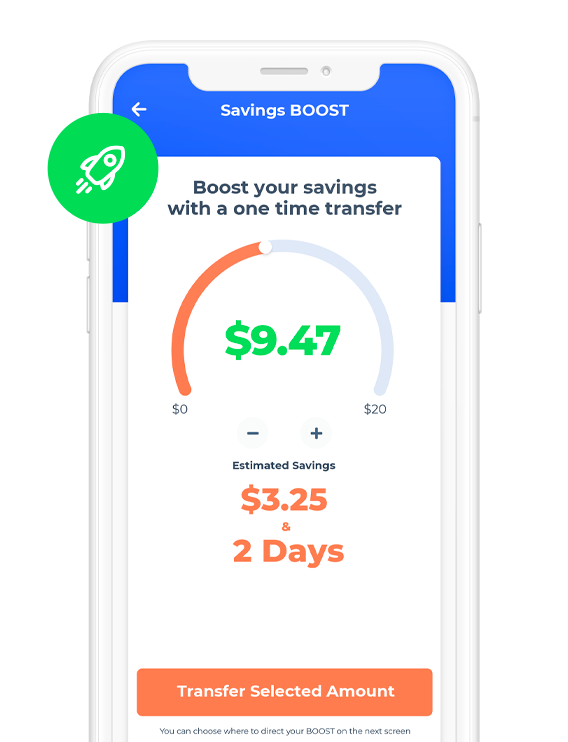

Boost Your Savings

With Boost, you can set one time or scheduled savings based on your budget. Schedule reoccurring Boosts to reach long term goals or a one time Boost today when you have some extra cash. The best part? Changed shows you estimated time and money savings based on your loved ones debt.

Stash and Payoff

Save for an emergency, pay off your loved ones debt, or do both. With Changed, you can use Stash My Cash to reach savings goals and automate your savings toward your loved ones debt with Payoff. You can split your savings between savings and debt pay off to optimize your finances to reach your dreams with less debt together.

Watch Debt Shrink

Changed automates your small savings into debt payoff progress. Each time your Payoff account reaches $50 in accumulated savings a payment is made to your loved ones debt. Track how much each payment saves them in time and interest. See how much sooner they will be debt free based on their debt and your savings. #RIPDebt

Discover how to start saving now.

Better Finances. Brighter Future.

Do What Works For You

Changed makes paying off your debt fast, flexible, and easy to get started.

Customizable Savings

Save and repay at your own pace. Choose Budget, Standard, or All mode so you find the pace of repayment that’s right for you.

Pause Transfers

Save on your own terms. Pause for 15, 30, or 60 days; whatever works best for your budget.

Changed Perks Programs

Earn Perk Points by referring friends and family and by reaching repayment milestones. Points never expire, and you’ll be entered in a raffle for a chance to win a free debt loan repayment.

Changed in the News

7 Tips to Prepare Yourself Before Student Loan Repayment

Student loan debt doesn't have to be a mystery. Learn about loan repayment before you get there.

Student Loan Repayment: A Family Affair

Changed has launched the Family and Loved Ones feature so those who want to help most, can.

Read more

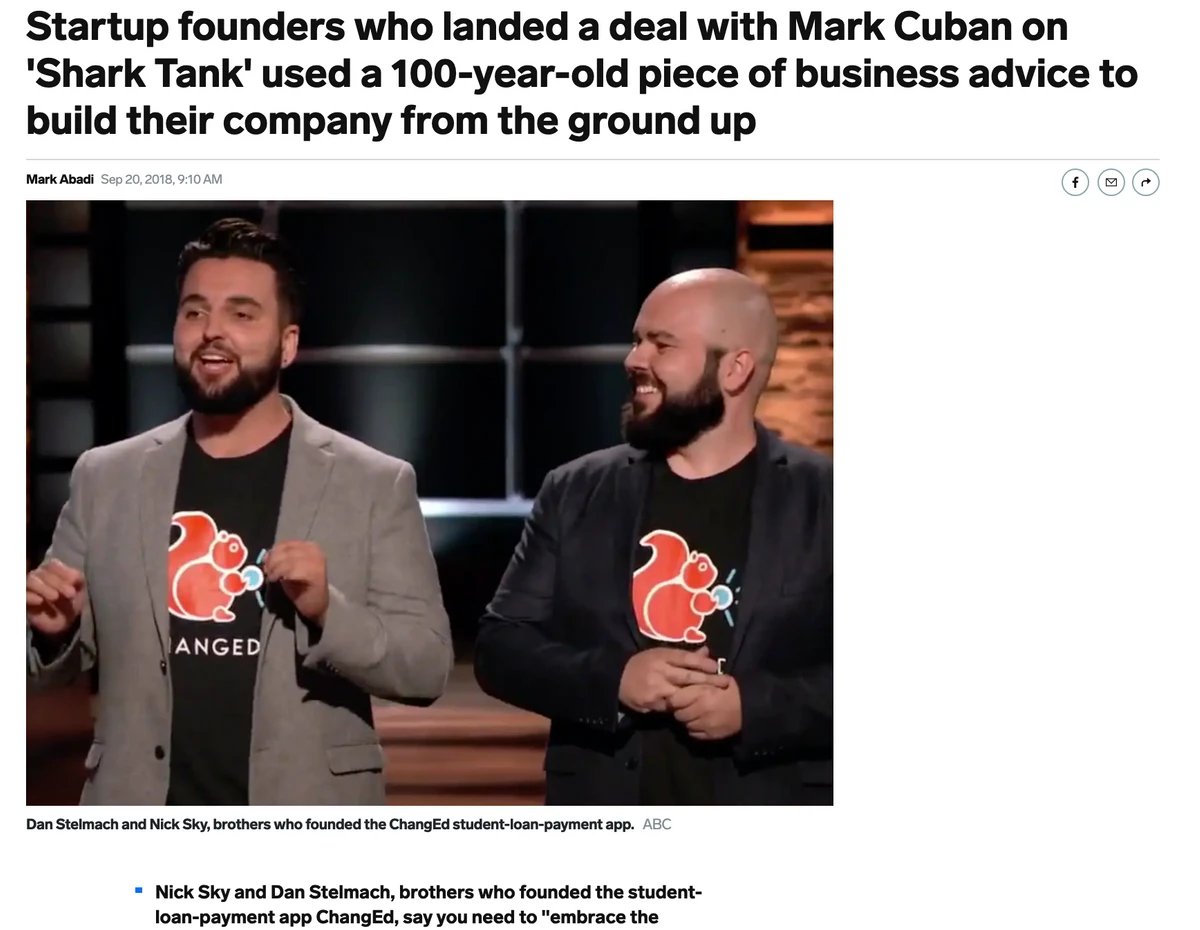

Changed on ABC's Shark Tank

Changed, an app that rounds up the spare change from your everyday purchases to help you pay off your student loans sooner and for less in interest costs, will appear on ABC's popular Emmy-Award-winning reality show Shark Tank Jan. 28 at 8 p.m. CT.

Read more

Changed Founders "Embrace the Broom"

Startup founders who landed a deal with Mark Cuban on 'Shark Tank' used a 100-year-old piece of advice to build their company from the ground up.

Read more

Changed Featured in Money Magazine

Three years ago, Dan Stelmach was stuck in a sales job he didn’t like, trapped by the $850 student debt payments he had to make each month.

Read more

Simple Tips to Knock Out Student Loans Debt

Discover simple steps you can start taking today to pay off your debt faster.

Read more