Paying down debt has never been easier

MSUFCU wants you to live a life free of debt and stress. Changed is an app that can help you do just that! After seeing the founders on Shark Tank, we knew this was a tool that our members needed! So we formed a partnership and are providing Changed to our members for FREE!

How it Works

1. Link your MSUFCU Accounts

2. Set up your Changed Profile

3. Changed automates savings and payments toward your debts!

No matter what stage of life you're in, whatever your next big financial goal, debt repayment can feel overwhelming. But with the right tools at your fingertips, you can take control of your debt once and for all.

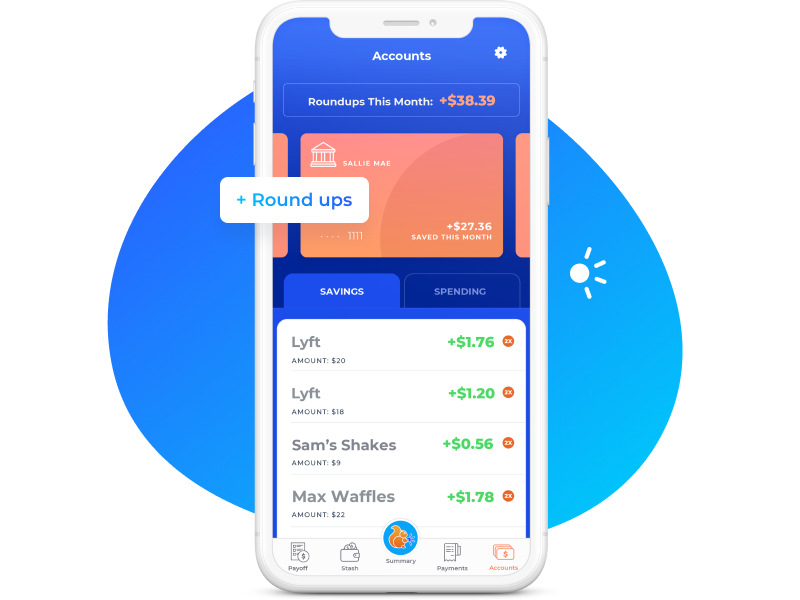

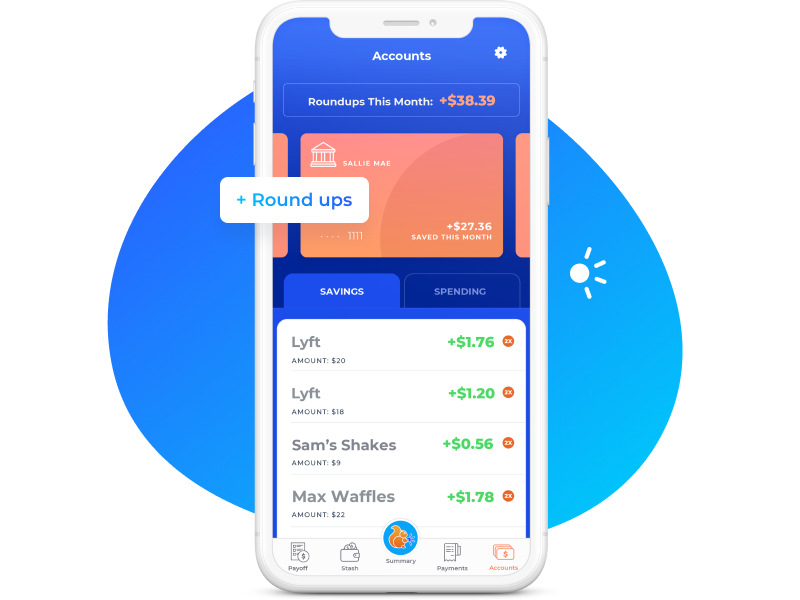

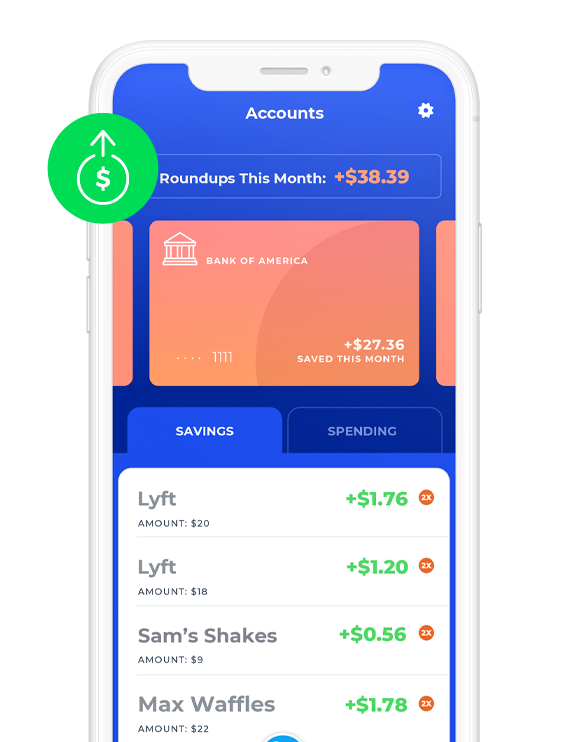

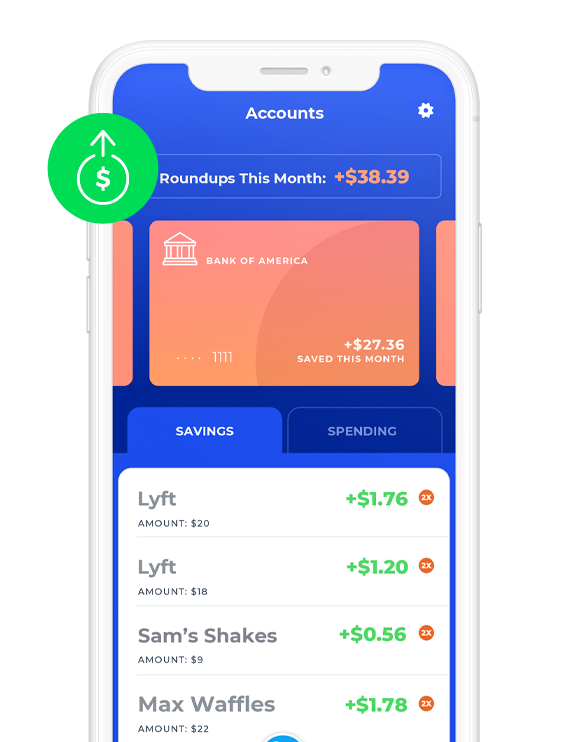

Round Up Savings

When Devin grabs a caramel macchiato in the morning ($4.73), or meets up with friends on the weekend for sushi ($22.64), she swipes her card and forgets the rest. So what if, in the background, that extra bit of change on every purchase was being put to good use?

That's exactly how Changed operates. Changed tracks your spending and rounds up to the nearest dollar, so you can save big over time without ever feeling the burn.

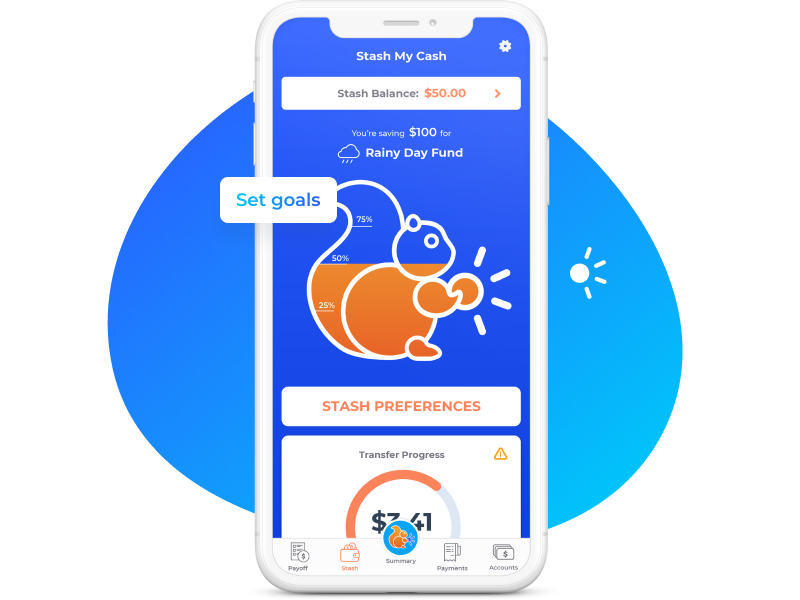

Set Savings Goals

Stuck between building your savings and paying down debt? With Changed, you don't have to choose. We help you establish an emergency fund, set aside money for a downpayment, or work towards any number of your money-saving objectives. It's streamlined savings, all from the palm of your hand.

Take Jake, for example. Jake didn't let paying down debt stand in the way of pursuing his dreams. In fact, thanks to Changed, he knocked out his debt repayment in just 5 years. Today, he's one step closer to purchasing the home of his dreams.

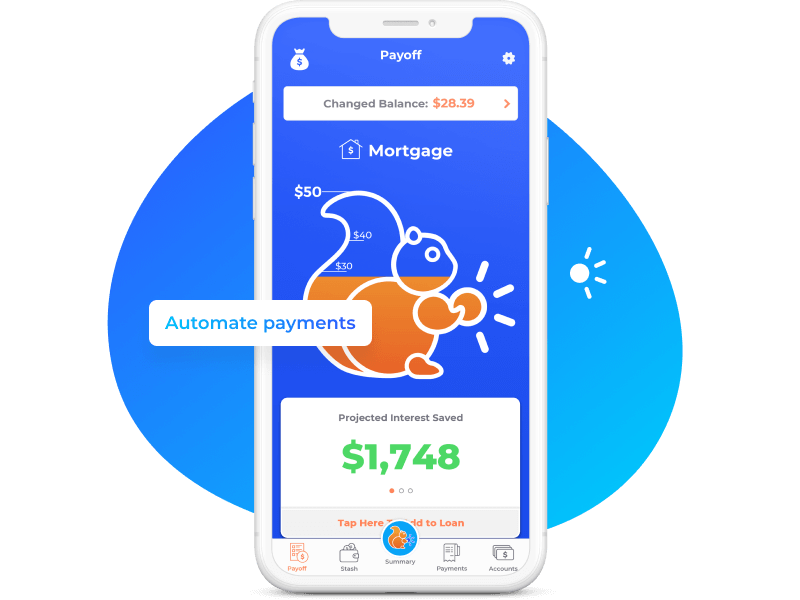

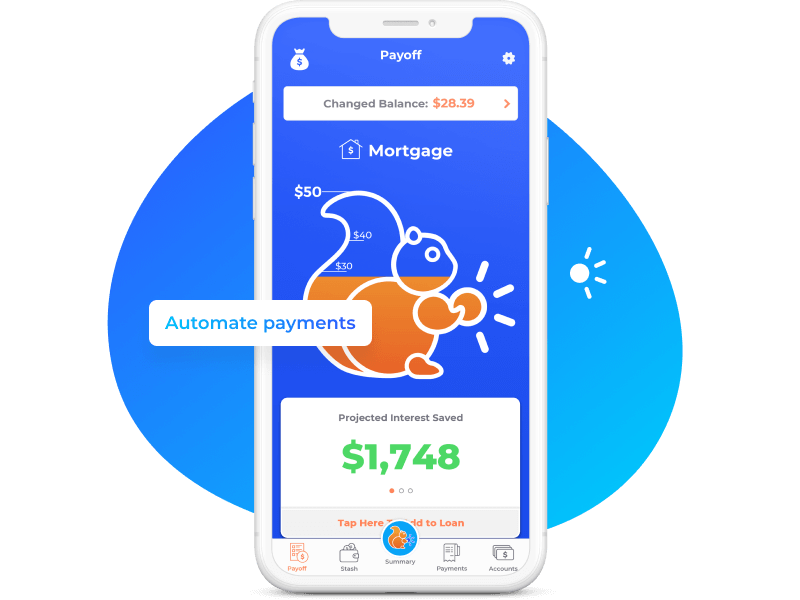

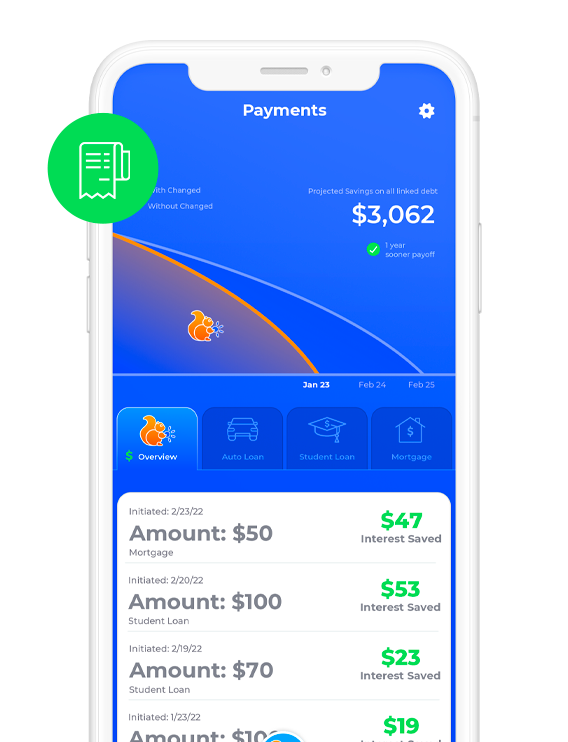

Automate Payments

For Aakash, automated means out of his way. Every time Aakash saves, those micro-savings go directly toward paying down his debt. That means Aakash is one step closer to living debt-free and jet-setting off into the sunset on his next travel adventure.

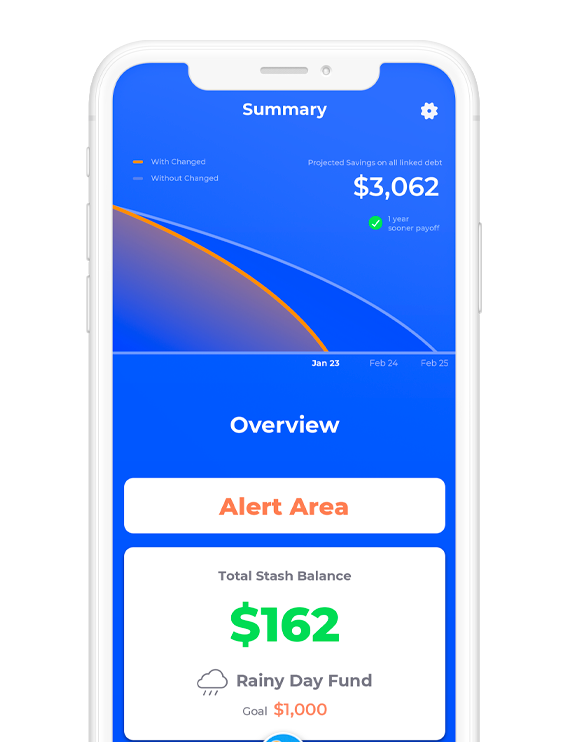

Track Your Progress

Keep the money-saving momentum going with in-app tools to track the progress of your savings. What better motivation than keeping tabs on your small victories along the way? That’s what Drew did–and look where he is now.

Find out how much you can save

Projected Savings

$X,XXX

![]() X months sooner payoff

X months sooner payoff

With Changed

Without Changed

Aug '30

Dec '30

Interest Saved:

$XXX.XX

Time Saved:

X years

This calculator estimates your savings based on use of Changed for the life of your loan. The calculator is an approximation and may not be accurate to your exact loan.

Changed is FREE for MSUFCU members.

Take a Look Inside the App

See how Changed helps borrowers and loved ones like you.

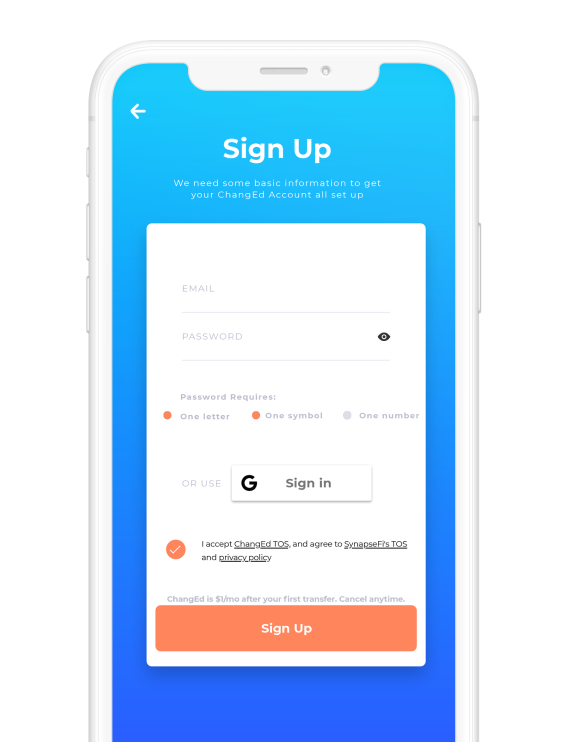

Create a Profile

Let’s start with the basics. To create and set up your personal FDIC-insured Changed savings account, we’ll need to know who you are. Build your personal profile including name, DOB, phone number, and address. With Changed, your information is always secured using bank-level encryption and security standards.

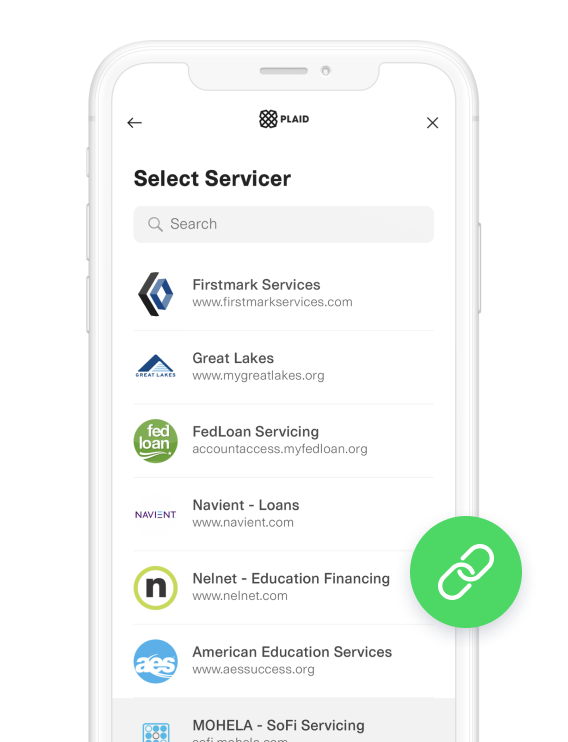

Link Your Loans

Time to link the loans you want to pay off sooner! Securely link your loans in the Changed app using your online login. No account numbers needed! Once you’re in, you’ll choose which account you want to pay down first. We cover all loan servicers and also offer a manual option for outside lenders.

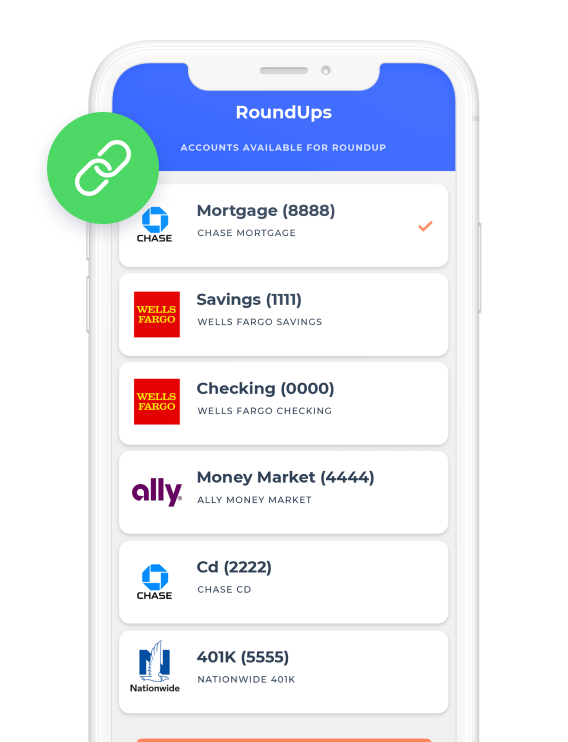

Roundup Your Accounts

Once your accounts are securely connected, you can choose which accounts you want to analyze for roundups. Choose what type of transactions get rounded up and even multiply your roundups so you control how fast you reach your savings goals. Savings are transferred each time you reach $5 in accumulated savings.

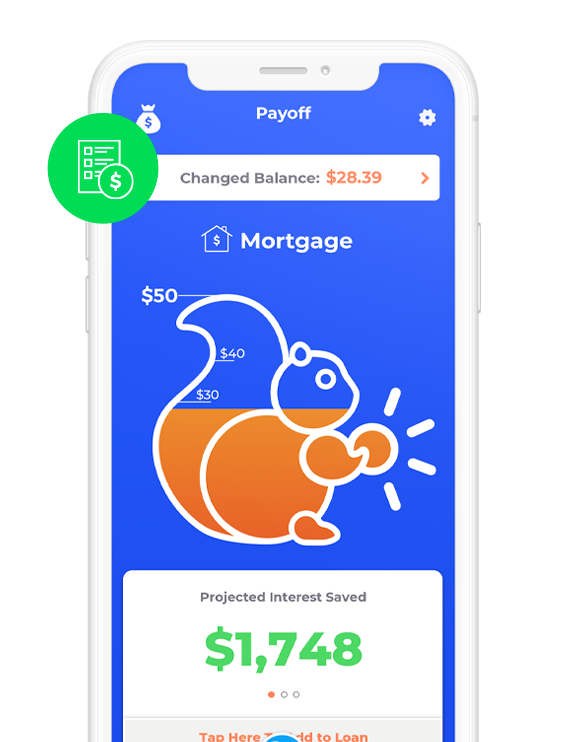

Stash and Payoff

Save for an emergency, pay off your debt, or do both. With Changed, you can use Stash My Cash to reach your savings goals and automate your savings toward your debt with Payoff. You can split your savings between savings and debt pay off to optimize your finances to reach your dreams with less debt.

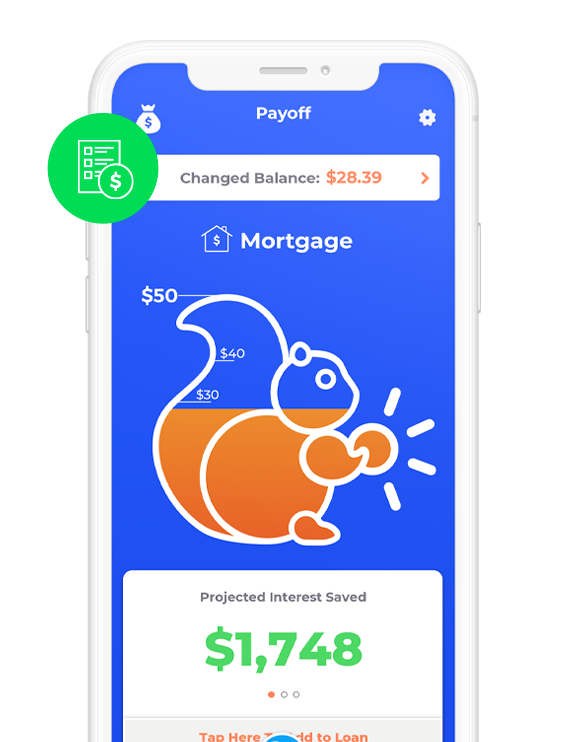

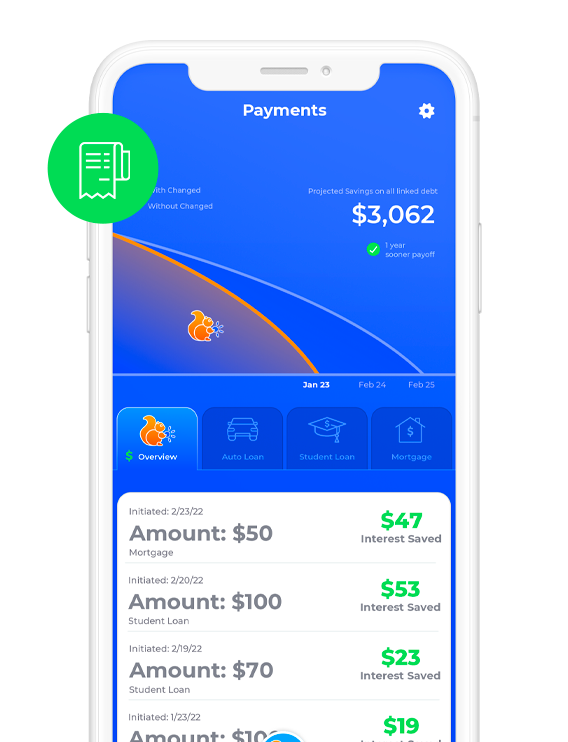

Watch Debt Shrink

Changed automates your small savings into debt payoff progress. Each time your Payoff account reaches $50 in accumulated savings a payment is made to your debt. Track how much each payment saves you in time and interest. See how much sooner you will be debt free based on your debt and your savings. #RIPDebt

It Takes a Village

Paying off debt isn't an easy task but Changed makes it easier. With our ability to add loved ones as contributors, multiple people can help pay off debt together. Help your kids pay off student loans or work together with your significant other to over come debt. With contributors, Changed can multiply your savings to a life without debt.

Create a Profile

Let's start with the basics. To create and set up your personal FDIC-insured Changed savings account, we'll need to know who you are. Build your personal profile including name, DOB, phone number, and address. With Changed, your information is always secured using bank-level encryption and security standards.

Roundup Your Accounts

Once your accounts are securely connected, you can choose which accounts you want to analyze for roundups. Choose what type of transactions get rounded up and even multiply your roundups so you control how fast you reach your savings goals. Savings are transferred each time you reach $5 in accumulated savings.

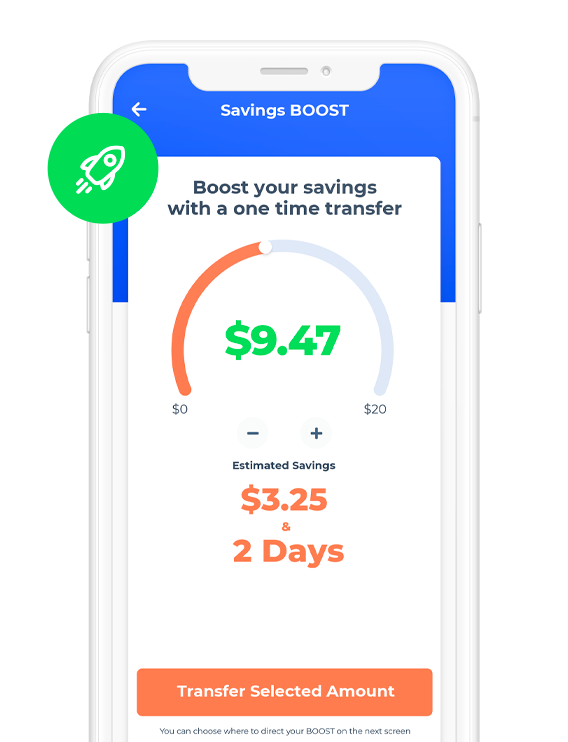

Boost Your Savings

With Boost, you can set one time or scheduled savings based on your budget. Schedule reoccurring Boosts to reach long term goals or a one time Boost today when you have some extra cash. The best part? Changed shows you estimated time and money savings based on your loved ones debt.

Stash and Payoff

Save for an emergency, pay off your loved ones debt, or do both. With Changed, you can use Stash My Cash to reach savings goals and automate your savings toward your loved ones debt with Payoff. You can split your savings between savings and debt pay off to optimize your finances to reach your dreams with less debt together.

Watch Debt Shrink

Changed automates your small savings into debt payoff progress. Each time your Payoff account reaches $50 in accumulated savings a payment is made to your loved ones debt. Track how much each payment saves them in time and interest. See how much sooner they will be debt free based on their debt and your savings. #RIPDebt

See the impact Changed has made on borrowers just like you

Do What Works For You

Changed makes paying off your debt fast, flexible, and easy to get started.

Customizable Savings

Save and repay at your own pace. Choose Budget, Standard, or All mode so you find the pace of repayment that’s right for you.

Pause Transfers

Save on your own terms. Pause for 15, 30, or 60 days; whatever works best for your budget.

Changed Perks Programs

Earn Perk Points by referring friends and family and by reaching repayment milestones. Points never expire, and you’ll be entered in a raffle for a chance to win a free debt loan repayment.

Your Debt doesn't stand a chance.

.png?width=1080&height=1080&name=MSUFCU%20Triple%20Shot%20(2).png)