Start knocking out your debt.

Debt can pile up quickly and linger far too long without the right repayment action plan in place. We do all the heavy lifting and create a repayment plan that's right for you. With plenty of customization options along the way, you can pay off debt while meeting major savings milestones too.

Save. Pay. Track. It's Simple.

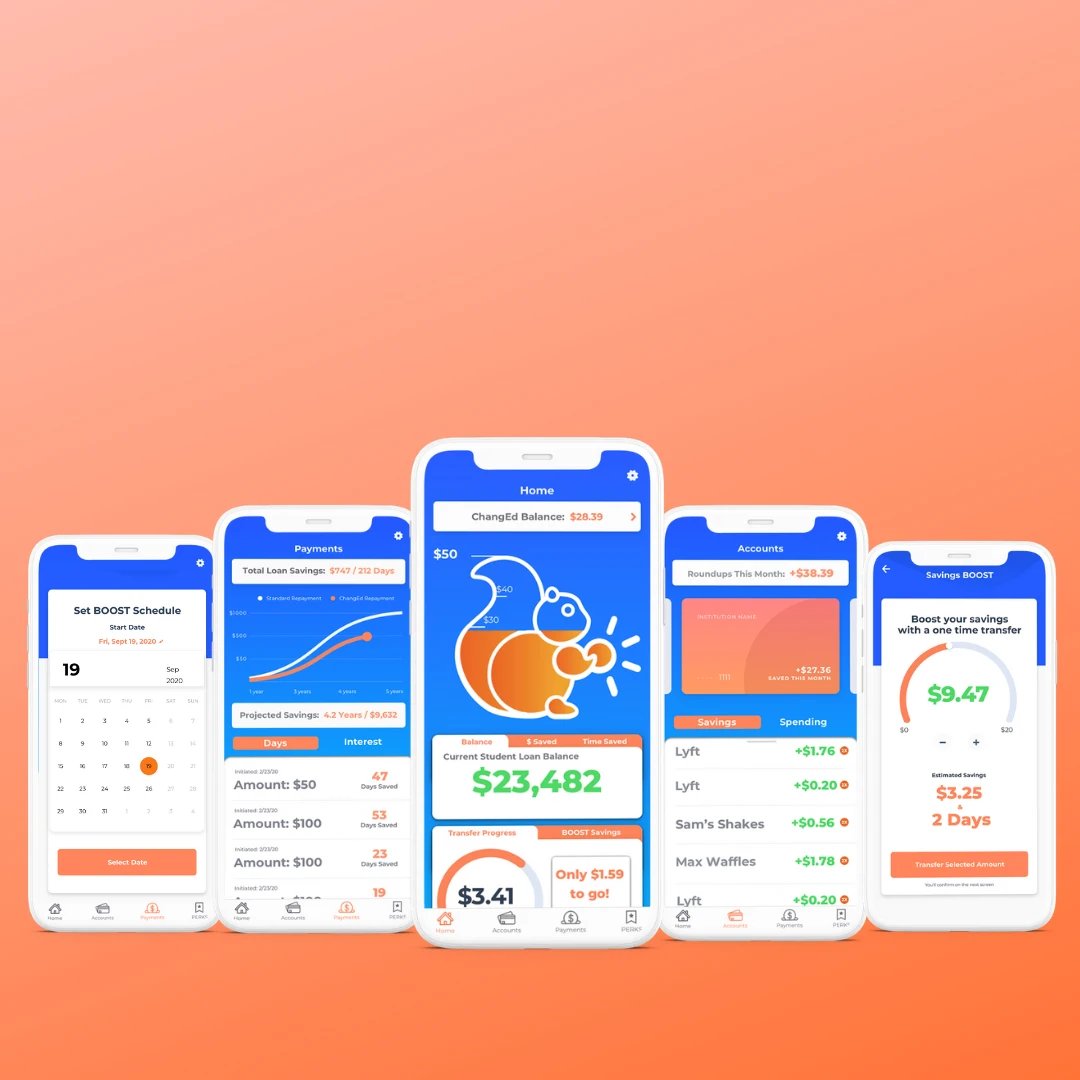

Take a Tour of the Changed App

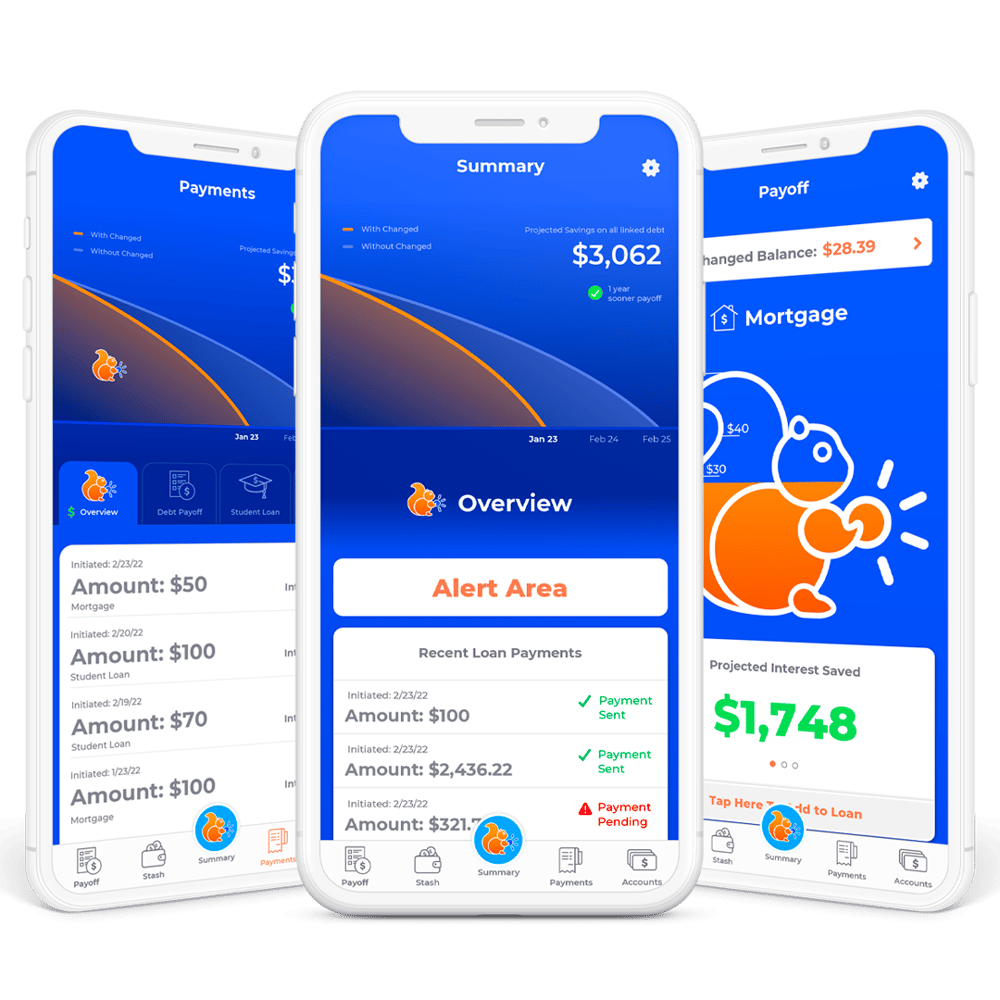

Tap into your Summary. Your Summary Dash is where you see all of your progress broken down in an easy to understand view. See how much you're projected to save, what other loans you can be paying off, progress you're making on your credit score and more!

Check out your Payments Dashboard. Track your payment progress and savings from your Payments Dash. See the money and time you're saving as well as your total projected savings.

Changed PERKS Program. Changed PERKS is the World's First rewards program that helps you earn money and prizes just for paying down your debt! Earn money back by referring friends and family or by reaching major repayment milestones. These points are then entered into a weekly raffle for a loan payment--on us!

How to Get Started

Step 1: Create a Profile

Set up your personal FDIC-insured Changed account. To begin, we'll need to get to know you a little. Add your name, date of birth, phone number, and address. Then we'll set you up to save!

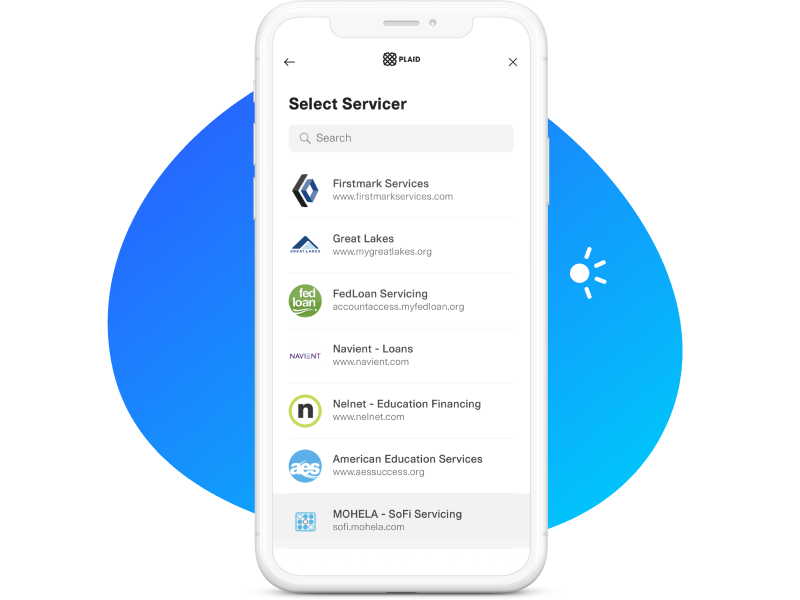

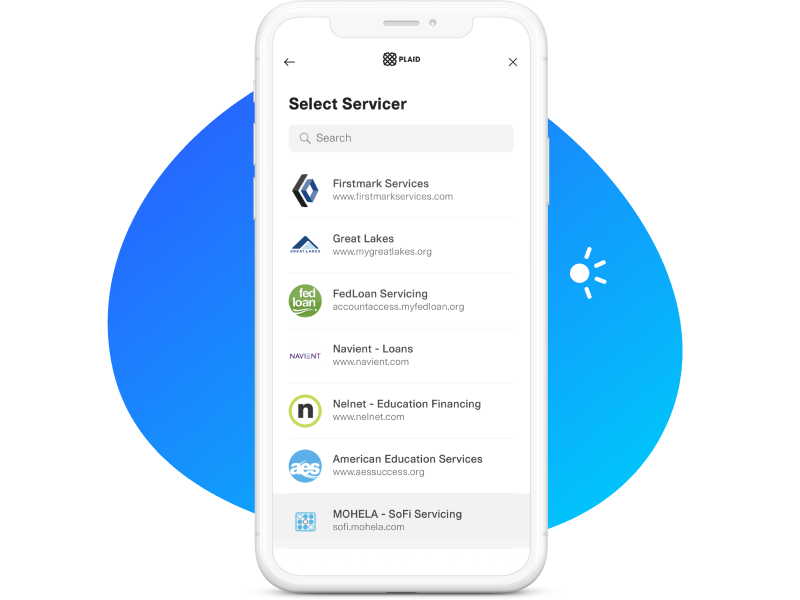

Step 2: Add Your Loan to Pay Off

Link all of your loans securely using your loan servicer's login credentials. Then simply choose which account you want to pay off first.

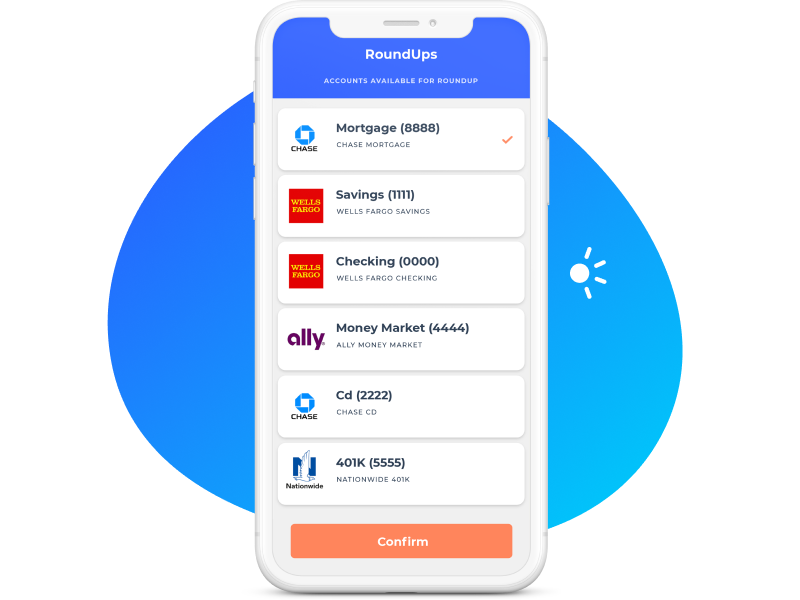

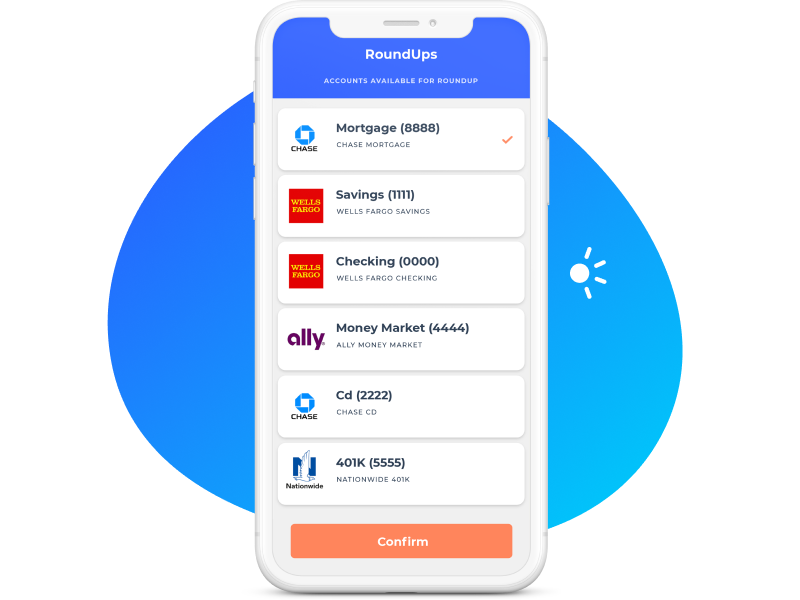

Step 3: Sync Your Banking Accounts

Last, securely link your bank and spending accounts. Select your preferred funding account for Changed to transfer funds. Changed analyzes roundups from multiple accounts and will transfer from one selected account.

Step 1: Create a Profile

Set up your personal FDIC-insured Changed account. To begin, we'll need to get to know you a little. Add your name, date of birth, phone number, and address. Then we'll set you up to save!

Step 2: Add Your Loan to Pay Off

Link all of your loans securely using your loan servicer's login credentials. Then simply choose which account you want to pay off first.

Step 3: Sync Your Banking Accounts

Last, securely link your bank and spending accounts. Select your preferred funding account for Changed to transfer funds. Changed analyzes roundups from multiple accounts and will transfer from one selected account.

Stash My Cash

Need to save up an emergency fund before or even while paying off your debt? We can do that too! Paying down your loans doesn't have to mean eliminating a safety net or pausing future savings goals.

Pay off your debt and start saving for a rainy day. We help you do both.

Our borrowers say it best:

Changed in the News

7 Tips to Prepare Yourself Before Student Loan Repayment

Student loan debt doesn't have to be a mystery. Learn about loan repayment before you get there.

Student Loan Repayment: A Family Affair

Changed has launched the Family and Loved Ones feature so those who want to help most, can.

Read more

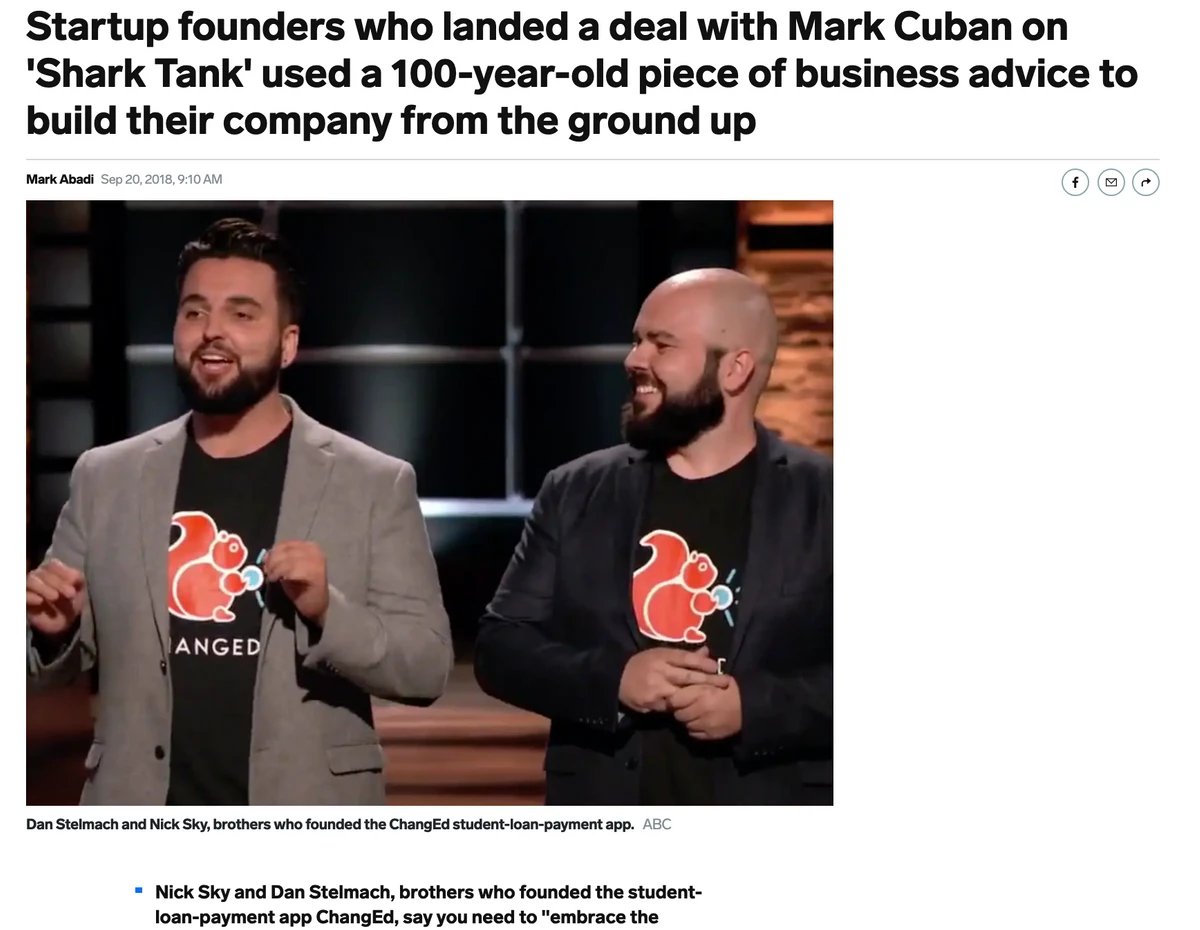

Changed on ABC's Shark Tank

Changed, an app that rounds up the spare change from your everyday purchases to help you pay off your student loans sooner and for less in interest costs, will appear on ABC's popular Emmy-Award-winning reality show Shark Tank Jan. 28 at 8 p.m. CT.

Read more

Changed Founders "Embrace the Broom"

Startup founders who landed a deal with Mark Cuban on 'Shark Tank' used a 100-year-old piece of advice to build their company from the ground up.

Read more

Changed Featured in Money Magazine

Three years ago, Dan Stelmach was stuck in a sales job he didn’t like, trapped by the $850 student debt payments he had to make each month.

Read more

Simple Tips to Knock Out Student Loans Debt

Discover simple steps you can start taking today to pay off your debt faster.

Read more